When Alastair Campbell suggested the transport industry should communicate more effectively on the essential nature of logistics, Suckling Transport’s Peter Larner rose to the challenge.

Speaking in February at a Motor Transport Directors’ lunch in Birmingham, Tony Blair’s former spokesman said key messages, placed on the side of trailers, could emphasise the vital role of logistics.

Less than two months later, that proposal has been put into practise by Peter Larner, one of the logistics industry’s most innovative directors.

Visitors to this week’s FPS Expo, can see Suckling Transport’s new tank trailer on the Lakeland Tankers stand. This tanker is the first to carry a new Love Logistics livery developed in association with the Freight Transport Association.

The first two trailers, which were built by Lakeland, bear the message

I’m delivering fuel to your local filling station …

… to save you collecting it from the refinery

Logistics – essential for everyday life

These tankers will operate on Suckling Transport’s contract with Shell at Avonmouth terminal.

Following Larner’s initiative, Abbey Logistics’ managing director, Steve Granite has also pledged to follow suit, saying: “It is important that the industry acts as a group on this one.”

Concerned that the merger of Total Butler and GB Oils would remove a key competitor to GB Oils; the Office of Fair Trading (OFT) referred the acquisition to the Competition Commission just before Easter.

In England and Wales, GB Oils has 100 depots whilst Total Butler has 40. Both supply a similar range of oil products to domestic, commercial and agricultural customers.

Of particular concern to the OFT is the supply to customers who require deliveries across multiple sites, but whose volumes are too small for them to be viably served by the major oil companies or by oil traders.

“Although there are a large number of oil distributors operating in theUK, three of them stand out in terms of the scale of their networks: the two merging parties and Watson Fuels,” said Amelia Fletcher, OFT chief economist and decision maker in this case.

“A significant number of multiple site, non-bulk customers, who need suppliers with access to such infrastructure, were concerned at the prospect of a merger of GB Oils and Total Butler. We consider that the Competition Commission should look in detail at the impact of the merger on these customers, as well as whether the merger may result in higher prices for customers buying oil products in specific local areas where the parties overlap.”

The Competition Commission is expected to report on the case by 18th September 2012.

Fuel Oil News launches new webinar service with Kan’to’s real time tank gauging

From May, the EU will be introducing changes that will affect the majority of live websites.

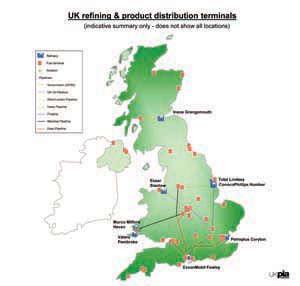

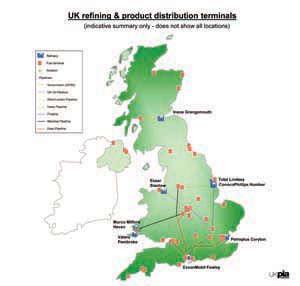

The UK had 18 refineries, it now has 8. Fuel Oil News recently put a series of questions about the state of the country’s refining industry to Chris Hunt, director general of the United Kingdom Petroleum Industry Association (UKPIA)

“The reduction in the number of UK refineries is very much progress driven and, reaction to changing market demand,” said Chris. “Refinery capacity has increased due to technological advances. Yes, the UK has fewer plants but the ones remaining are more efficient.“Plus, an inevitable consequence of the UK and EU drive for energy efficiency is demand destruction. With more efficient engines, demand for refinery products such as petrol continues to decrease but, until the recent recession this has been offset to a large degree by increased consumer mileage.“On the other hand, being more efficient in our oil consumption is a good way to achieve our carbon reduction without sacrificing our mobility. It also helps conserve supplies of this finite resource.”

In with the new As most majors have retreated from downstream, new players have entered the refining arena. “We welcome these newcomers, they’ve brought a fresh dynamic to UKPIA,” said Chris. “Whilst they don’t have the deep pockets of the integrated oil majors, their flat command and control structure offers a different business model.Q: So what do investors like Petrochina, Essar and Valero have to gain in our mature industry?

“A very handy toehold in Europe,” says Chris. “In Stanlow and Pembroke, Essar and Valero respectively, have acquired good assets relative to European standards. At Grangemouth, Petrochina and INEOS are using the site to develop an impressive chemicals portfolio.”

A large refinery reputedly contributes £60 million to the local economy. “Closed in 2009, Petroplus’ Teesside refinery was an ex-ICI plant, very simple in refinery complexity terms but closely integrated with petrochemical activities. The loss of that critical mass, and the associated high value jobs at these plants, has had a big impact on an area of the UK which can ill afford such a hit.”

Q: So will the UK ever see a new refinery?

“It would be difficult to see a case for building a new refinery – capacity wise we just don’t need it. But, under the right conditions and, with the right incentives, investment could be made at the remaining facilities.”

Q: What are the right conditions?

“They will be when the vital contribution of the UK’s oil industry to our energy security is fully recognised. It also requires a level playing field where UK refineries are not disadvantaged against European or global competitors.

Q: Will there ever be a level playing field?

“There could be,” said Chris. “It could be achieved if the UK and EU recognise that we can’t go it alone on some aspects of environmental policy. We may be world leaders in climate change policy but we must also consider the cost to our manufacturers.”

Coming soon – a refining strategy for the UK and a stock holding agency

In his introduction to UKPIA’s report on Fuelling the UK’s future: the role of our refining and downstream oil industry published in November 2011, Brian Worrall, then UKPIA president, said: “Given the right policy environment, the UK refining and downstream oil sector can continue to play a pivotal role.

KPIA and its members look forward to continuing to work with government and policy makers to achieve this goal.

Q: So, how receptive is the UK government to the oil refining industry?

“Very receptive,” reports Chris. “We’re finally moving forward on a proper refinery strategy for the UK which will be published in the third quarter of this year. We started lobbying in spring 2011 so this is quite a step forward.

“We also have a green light to progress an independent industry-funded agency to manage the UK’s compulsory oil stock holding. Administered by a board via obligated companies, the agency is expected to be functioning by 2014.”

Q: Does UKPIA now believe the government will apply policies that do not place the UK at a commercial disadvantage?

“We certainly hope so,” said Chris. “We expect that the refinery strategy exercise will lead the government to this conclusion. The problems at Coryton really galvanised the government into action – it provided clear evidence that refineries can and do shut; although in the case of Coryton, we very much hope a buyer will be found.

“For years, UKPIA has been saying that refineries could shut but, it took the demise of Petroplus to move refining up the political agenda. It reminds me of Spike Milligan’s epitaph – I told you I was ill.”

More challenges in the pipeline

Marine fuel – “Imminent changes in the specification of marine fuels will have a big impact. Under MARPOL proposals, the 2020 specification will see sulphur levels move closer to that of diesel. The effect on both the refining process and bunkering will be colossal. A substantial price increase may see ship owners chose the cheaper option of onboard scrubbing of exhaust gases to remove sulphur.

“Even by 2035, the International Energy Agency expects 80% of EU transport fuel demand to still be met from oil derivatives with most demand met by ordinary fuels particularly for the aviation and marine sectors,” added Chris.

Biofuels – UKPIA’s communications director, Nick Vandervell, who was also present at the interview, told FON: “Most biofuels currently used are first generation with complex sustainability issues in some cases. Second generation biofuels from biomass or advanced biofuels from algae for example, may have potential in the future.

“We see a more diverse fuel mix for transport including electric vehicles,” added Nick. “Technology favours hybrids unless there’s a breakthrough in battery technology in the short term.”

Q: Will we achieve 10% biofuels by 2020?

“Biofuels bring many issues, such as approval by vehicle manufacturers, storage and use and sustainability” replied Chris. “It’s likely that only by incentive – make the price the same or even cheaper – that people will switch to higher blend biodiesel.“

Kerosene – “Relative to the grand scheme of things, heating kerosene is a tiny market,” says Chris. “It’s very much a commercial issue. Distributors are not willing to invest in storage – an expensive asset for such a seasonal product. Demand patterns are difficult to predict, supplies can be problematic particularly in times of severe weather when supplies can be drawn down rapidly. Co-operative buying could be a way forward or maybe we need to switch to gas oil….?

The future

Q: Does UKPIA expect further UK refinery closures?

“No, we don’t expect more closures. As the reality of future supply problems has started to bite, UKPIA doesn’t believe that Europe will give up on refining.

“Total retaining the Lindsey refinery for the foreseeable future was welcome news as this plant has had the most recent major investment to increase diesel output.”

Q: Will the UK become just a storage facility?

“I can only contemplate the UK relying on more imported product if we lose the existing refinery structure. And, I cannot conceive that a government of any colour would allow this to happen.

“Some say that the UK could be supplied by imports, but that wouldn’t last forever. Being reliant on supply at the end of a long chain is problematic. Plus, bringing in finished product comes with shipping, jetty and pilot issues.

“The government, the industry and the country needs to ask the question – would we be happy being at the end of a supply chain from challenged areas of the world?

Q: What is the prospect for a ‘healthy, robust oil refining industry’ in the UK?

“We’ve got to be optimistic; we absolutely believe that a healthy, robust oil refining industry is achievable.”

FON recently reported on a Shropshire-based charity that had secured a government grant to help people join a fuel-buying scheme. The £3000 grant is being used to make the scheme available to people who would otherwise be unable to pay for membership

The above group is just one of a growing number of community schemes across the country. And it’s not just in oil that such schemes are spreading…

The Big Switch campaign, a collaboration between Which? and pressure group, 38 Degrees, already has more than 60,000 participants. The ‘trailblazing scheme’ offers energy customers the opportunity to club together to secure optimum prices from energy suppliers. Group-buying firms, Incahoot and Utility Warehouse also offer discounts on energy.

In Oxfordshire, an organic farmer is encouraging community ownership of renewable energy projects. In 2004, Adam Twine, gave locals the opportunity to own shares in the wind farm on his land. Eight years on, he is offering the local community ₤4.5m shares in a new 30-acre solar project.

Back to oil, The Times recently reported on a free website which is taking the idea of community buying onto a national level. www.oil-club.co.uk, which was founded by Chris Brown, combines smaller purchasers into one big body.

Distributor views

Although popular with consumers, community fuel buying groups are not viewed favourably by all distributors. Tony Deakins, of Shropshire based Deakins Fuels, told FON: “I’m very much against such schemes. I don’t supply any buying groups, as the majority of deliveries involved tend to be minimum delivery (500 litres) and are often not straightforward. Most of our customers seem to value our level of service and realise that another tier of ordering – for a minimal saving – simply removes them from any close relationship they may have with their distributor.”

Shropshire distributor, Oakleys Fuel Oils is not totally against buying groups, but does have some reservations. “There’s nothing wrong in principle if a group consists of a few houses and involves a sensible size load. One tanker delivering to a small, close-knit community is a sensible option for both parties. When groups start to spread county-wide, deliveries are scattered and the members want the oil unrealistically cheap, then it simply doesn’t work.”

Talking about the aforementioned Shropshire scheme in particular, Richard says he was shocked that Oakley’s, as one of the county’s biggest distributors, was not asked to supply the group. He also thinks that distributors are inadvertently giving buying groups more leverage by quoting inflated prices when they are not interested in supplying, rather than simply declining. When the group is eventually quoted a more realistic rate, it will then claim to have delivered its members a large saving.

Richard makes the point that the industry should have a format to adhere to when dealing with buying groups. He also questions: “What do the group organisers get out of these schemes? A lot of these groups are run as businesses. Are they in fact taking a wage? Why don’t they just make an honest living out of it and buy a tanker themselves?” This is a sentiment echoed by Tony Deakins, who also questioned the role of group co-ordinators.

Hingley and Callow director, Helen Needham, made her feelings on the subject quite clear: “Community buying groups – now there’s a topic! The bane of our life! And, which bit of community buying allows the organiser to take more of a margin than us the supplier?! I had one the other day wanting to take 4ppl!”

Mark Askew, chief executive of the Federation of Petroleum Suppliers was recently quoted in The Times as saying: “Small, local buying groups in a neighbourhood can benefit from the saving the distributor makes on travel time and costs. However, size is not always a benefit when purchasing oil through buying groups. People should be realistic about the level of savings.”

Oxfordshire initiatives

In a bid to save money and make their village a cleaner and safer place to live, residents of West Challow, Oxfordshire, operate an oil buying group. Local distributor, Sweet Fuels, has been supplying the group for three years, and also supplies a number of others in the area. Owner, Adrian Sweet said: “We supply about 20 groups in total. For the majority of these groups, we deliver once a week, offering members a discount off the ring round price. It works really well. However, we don’t supply the larger buying groups who routinely contact at least 10 companies to negotiate the cheapest price.”

According to a recent article in the Banbury Cake, residents across Oxfordshire are benefiting from the roll-out of a scheme, which has already saved thousands of pounds. The scheme, which was originally launched in 2010 by Oxfordshire Rural Community Council (ORCC) and Chris Pomfret of Community Buying unlimited, has saved householders a reported £71,151. The initiative, which requires residents to pay an annual fee of £20 and place their order through a local co-ordinator, has now been rolled out in 19 of Oxfordshire’s 37 Rural Community Partnerships.

Peart partners housing association

In North Yorkshire, F. Peart & Co has partnered with Broadacres Housing Association, offering an oil scheme to help residents take control of their energy bills. Broadacres Housing Association, which provides a range of services to over 5200 homes, sought a solution for its tenants, who sometimes find it difficult to purchase heating oil in bulk.

“We were concerned that a number of our residents were living in fuel poverty and couldn’t afford the cost of their oil upfront, so we decided to set up a contract with an oil distributor to resolve this issue,” explained a company representative.

As part of the scheme, residents are not required to pay any bills at the time of delivery and instead a direct debit is set up with the housing association, which then pays F. Peart & Co direct. Laura Jackson, business manager at the company, said: “Paying by direct debit is the safest and simplest method of payment and gives the tenant peace of mind that they’ve paid on time. A regular monthly payment also makes it easier for customers to budget for their heating oil.”

Since its launch, 154 residents have joined and are now benefitting from the initiative.

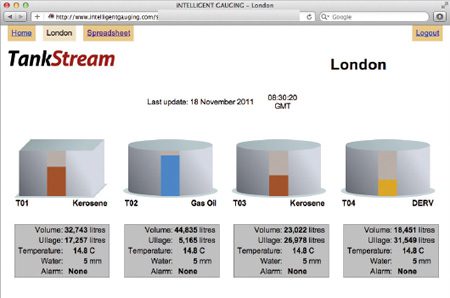

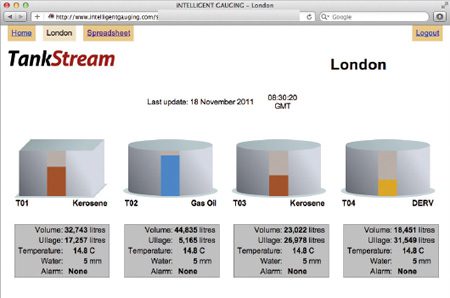

New products from TankCare UK (an OTS Group company) include TankStream, a fuel quality and wetstock monitoring system for dispersed fuel storage installations.

Designed to provide real time updates, the system works in conjunction with an integral fuel conditioning system which recirculates and treats the wetstock to prevent microbial growth contamination.

“With higher content biofuels having resulted in greater amounts of water in suspension, fuel quality can very quickly deteriorate if not treated immediately,” says OTS sales director, Steve Gain. “Fleet managers want a more intelligent approach; TankStream allows them not only to check fuel stock availability, but also the fuel’s condition.”

TankStream’s instrumentation will monitor up to eight tanks and eight sensor packs. Tank contents are polled every 20 seconds and the data is automatically uploaded to the internet.

Real time stocks and alarms can be relayed by email and the situation reports streamed to any web browser, either mobile or at any geographic location with internet access. The system can also be scaled up to incorporate the smart control of pumps sets with the ability to reset fuel dispensers remotely via the web.

www.tankcare.eu.com

Kingspan Environmental’s SonicSignalman electronic oil-level monitoring system now has a NEW SMS feature, allowing oil companies to send text messages to end-users. The SonicSignalman is a onepart device that uses the latest ultrasonic and GSM technology to remotely monitor the level of oil in a customer’s tank. The new text message facility will enable oil companies to send updates to customers about promotions and planned delivery runs. Messages can be broadcast to all customers or sent to those in specific geographical locations. The information received back can be used to improve logistics, reducing the number of wasted deliveries and spreading periods of peak demand.

www.sensor-systems.com

Kan’to Instruments has recently completed a major installation for Finol Oil, one of the leading lubricant suppliers in Ireland

Dimitri Papaioannou, managing director of Kan’to, told FON: “We’ve now completed the installation of an automatic tank gauging system – using our iLevel gauges and iNTELLIGENTGAUGING software The whole project was very successfully managed by our agents and distributors in Ireland, Re-Antechnology Services, with managing director, Ian Gillespie, playing a pivotal role.”

Liquid storage applications The Kan’to iLevel console was developed as a solution for inventory and alarm management in liquid storage applications. It provides delivery and inventory reports, real-time telemetry and can be accessed using a web-based interface or by computer based software. The console can monitor up to eight tanks simultaneously, and is available with a wide range of probes, providing up to +/- 1mm in accuracy.

This month Dublin-based Finol Oils is celebrating 35 years in business. “We operate 20 bulk lubricant storage tanks ranging in size from 8000 to 42,000 litres,“ said Dominick Purcell, chief executive officer. “We’re very happy with the new Kan’to system. Compared to our older system, it’s greatly assisting us with stock levels and control. RE-AN International Technology Services installed and commissioned the system in a timely and efficient manner.”

Ian Gillespie added: “Up to the installation of the Kan’to system, the company had issues that impacted on their stock control management. To address the problems, all Finol tanks were surveyed and calibrated in association with Fuelling Technology, so that we could specify a complete stock solution. By all accounts, Finol are very pleased with the stock solution provided.”

www.kanto.co.uk

Webinar with Dimitri Papaioannou: https://fuelondev.wpengine.com/2012/04/kantos-real-time-tank-gauging/

Free software updates have been introduced for Dunraven’s Apollo Smart heating oil energy monitor. “There’s nothing worse than buying technology today, only to find it’s out of date tomorrow,” said Gerry Jones. “That’s why our customers can be assured that no matter when they purchase their monitor, it can always be running the very latest device software.

“Downloading the software updates couldn’t be easier. Simply download and install the update and device drivers from the Apollo website, plug in the monitor’s USB cable to your computer and the software will be installed in minutes. Apollo Smart allows consumers to monitor heating oil consumption, fuel costs and CO2 emissions on a daily, weekly, monthly and annual basis.”

www.dunravensystems.com