News

Investors welcome Shell net zero emissions plan

Commitment to achieve net zero emissions by 2050 “or sooner” is part of the significant action on climate change outlined by global energy company Shell following engagement with investors as part of Climate Action 100+.

Building on commitments of previous years, Shell will be publishing a series of detailed steps to achieve the plans outlined in the oil giant’s Responsible Investment Annual Briefing in April. These will include an ambition to be net zero on emissions from the manufacture of all products (scope one and two) by 2050 at the latest, accelerating its Net Carbon Footprint ambition and, most crucially in terms of the wider impact, ”pivoting towards serving businesses and sectors that by 2050 are also net zero emissions.”

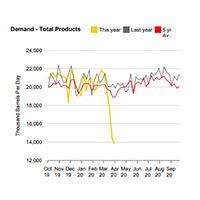

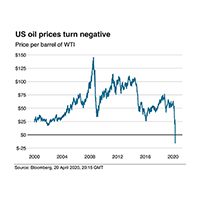

It comes during a period of immense challenge for the global oil industry, with demand forecast by the IEA to fall 29 percent in April and 9 percent this year as a result of the coronavirus pandemic. IEA executive director Fatih Birol, said 2020 was likely to be “the worst year in the history of global oil markets.”

But Shell chief executive Ben van Beurden suggested the company’s net zero commitments would not be derailed by the crisis.

“With the COVID-19 pandemic having a serious impact on people’s health and our economies, these are extraordinary times,” he said. “Yet even at this time of immediate challenge, we must also maintain the focus on the long term.

“Society’s expectations have shifted quickly in the debate around climate change. Shell now needs to go further with our own ambitions, which is why we aim to be a net zero emissions energy business by 2050 or sooner. Society, and our customers, expect nothing less.”

Wider impacts

As one of the world’s largest energy companies, Shell’s commitment to realising net zero emissions is of significance for the broader energy sector.

“It’s imperative we see companies across the entire oil and gas sector put strategies in place to achieve net zero emission if we are to tackle climate change. This applies to the fuels and products companies sell, as well as emissions from operations,” explains Stephanie Pfeifer, a member of the global Climate Action 100+ Steering Committee and CEO, Institutional Investors Group on Climate Change (IIGCC). “Investors will now look to other energy companies to match, and build on, the welcome ambition Shell is showing.”

After previous announcements in 2017 and 2018, Shell’s example has been followed by other oil and gas companies. With investors hoping that the latest announcement will again have a domino effect Simon Pilcher, chief executive of USS Investment Management, echoed the feelings of many; “As investors we need to be ambitious in our expectations of how the companies in which we invest can address the shift to a low carbon future and today’s announcement demonstrates that collaborative engagement can encourage corporate action on this crucial issue.”

The announcement has additional significance, given the short to medium-term implications of the Covid-19 pandemic faced by the sector as Fiona Reynolds, a member of the Climate Action 100+ Steering Committee and CEO, Principles for Responsible Investment (PRI) observes; “As we can see from this time of crisis, it is not possible to separate the health of people, the planet and the economy, as they all need to be aligned.

“Timely action to address the devastating social and economic effects of Covid-19 is essential and we welcome Shell’s significant commitment to become a net zero emissions energy business by 2050. It’s imperative that companies continue to focus on the long-term impacts of investments on the climate.”

Peter Ferket of investment giant Robeco, commented; “The new ambitions prove that the strong and committed engagement of institutional investors with Shell can help accelerate the pace of change to deliver the goals of the Paris Agreement,” he added. “It raises the bar and sets out an approach for others in the oil and gas sector to follow.”

The plan is the latest in a series from Shell and other oil majors to bolster their emissions reductions strategies. Earlier this year BP similarly unveiled wide-ranging net zero ambitions, while several top oil firms have acquired leading clean tech firms in a bid to diversify their portfolios.

Total is also facing increasing pressure from shareholders to step up its climate targets, after a group of investors recently tabled a resolution calling on the French oil major to set absolute emissions reduction targets for its entire business and value chain aligned with the Paris Agreement goals.