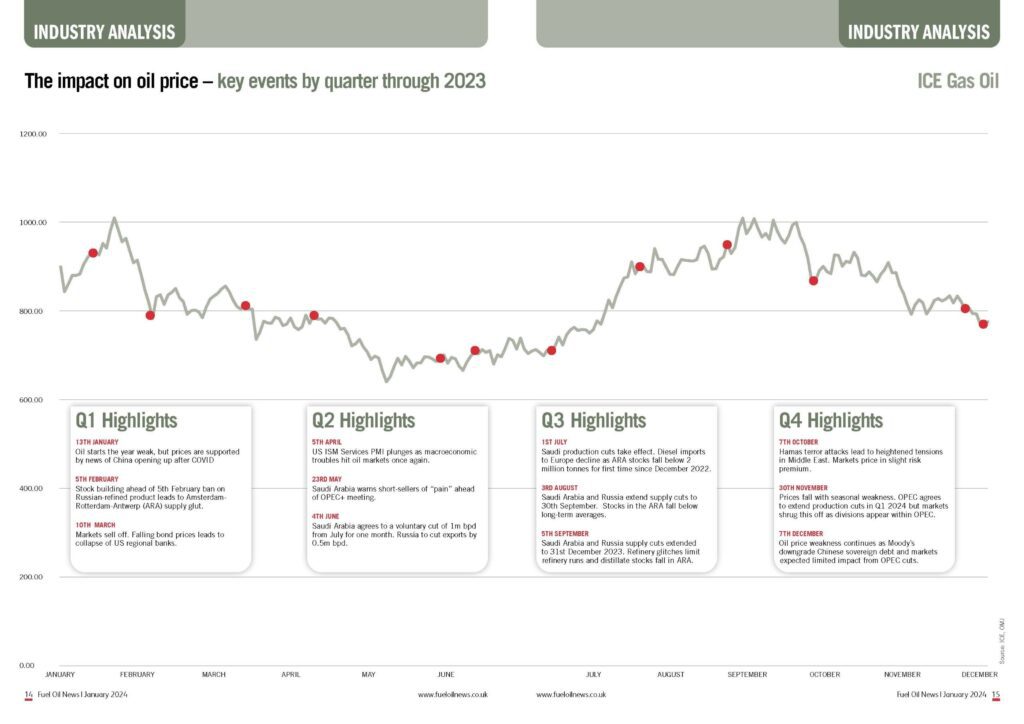

Pictured below and included in the January issue of Fuel Oil News is a graph that shows the price of ultra-low sulfur diesel throughout 2023.

With data supplied by The Oil Market Journal, the markers highlight some of the key events throughout the year that have impacted on the pricing. We hope it provides an interesting look back over a year which, once again, presented unforeseen and unpredictable challenges.

At the time of going to press, in mid-December, oil prices have had an “up and down” year as supply and demand pulled prices in either direction. It was another volatile year with a year-to-date price range on ICE Gasoil of 636/t. – 1,000/t. This size of range has become the norm post-COVID, although it is much lower than 2022’s annual range of 836.75/t, and is lower than 2020’s range of 418.75/t. Despite being lower than recent years, the range is much higher than 2019’s $153/t. and 2018’s $250/t.

Prices were particularly volatile at the start of the year, as news of China reopening and the impending ban on Russian diesel led to sharp rises. Prices quickly fell back, however, as a wave of diesel entered the ARA storage hub and macroeconomics began to stoke demand fears (a theme that would persist through 2023).

Production cuts and unplanned outages

With an abundance of diesel stocks amidst some of the most aggressive monetary policy tightening not seen since the 1980s, oil prices fell during Q1 and Q2. The weakening of global oil markets led the OPEC+ cartel to cut production by 2 million barrels per day. As prices remained weak several OPEC+ countries, led by Saudi Arabia, would voluntarily cut production further. Eventually, Saudi Arabia agreed to voluntarily cut production, until the end of the first quarter of 2024, by 1 million barrels per day.

Production cuts began to bite, and European refineries were hit with unplanned outages in the summer months. As a result, oil prices began moving higher, with ICE Gasoil pushing above $1,000/t. and ICE Brent Crude peaking at $95.55/b. ARA diesel inventories began falling below long-term averages as the reality of leaving Russian diesel behind hit markets.

Weakening demand

Early October saw the tight supply side overtaken by fears over weakening demand as macroeconomic troubles hit market sentiment. “Higher for longer” interest rates amidst strong US economic data led to a surge of US treasury yields as the 10-year and 30-year both hit 5%. Prices continued to fall, despite markets beginning to price in looser monetary policy in 2024 as demand growth concerns persisted. US crude oil production also reached all-time highs in another blow to OPEC.

With prices falling, markets began to speculate on more OPEC cuts. More voluntary cuts were announced amidst OPEC infighting, but markets shook these cuts off as they believed they would not materialise.

Q1

Q1 2023 was driven as much by macroeconomic factors as it was by oil supply and demand. ICE Gas Oil rallied to a peak of $1,012.25/t. as China reopened its economy after three years of COVID lockdowns. However, rising distillate stocks, along with interest rate hikes and banking instability, pushed the important European distillate benchmark ICE Gas Oil to a low of $721/t. on 23rd March 2023. This was also the lowest ICE Gas Oil had traded at since 11th January 2022. Oil fundamentals were generally weaker. ARA diesel stocks broke above the 5-year average in February, while US crude stocks rose 14% during the quarter. US diesel stocks also saw a contra-seasonal increase in stocks. Along with weak fundamentals, macroeconomic headwinds pressured prices lower. The collapse of Silicon Valley Bank and the rescue of Credit Suisse by the Swiss National Bank and UBS led to fears of recessions and reduced demand, causing oil to fall to one year lows.

Q2

Q2 started with a sharp rise in oil prices following OPEC’s surprise voluntary production cut towards to the end of Q1. The rally was, however, short lived and ICE Brent Crude fell towards $71/b as the potential supply tightness was undermined by the weakening macroeconomic outlook. The US Regional Banking crisis, tightening monetary policy, and slowing industrial demand, all played a role in capping ICE Gasoil at $700/t as diesel demand began to slow. The Eurozone also entered a mild technical recession. Argus reported a sharp fall in ARA gasoil stocks during the quarter. Stocks fell 399,000 (17%) during the quarter, and hit their lowest level in 25 weeks. Gasoline prices also began to overtake diesel prices following the seasonal transition to summer gasoline and the start of the US driving season.

Q3

Q3 was a quarter driven by tightening global fundamentals as Saudi Arabia and Russia began cutting oil production, with the first cuts taking effect in July. As the quarter progressed, Saudi Arabia and Russia extended their production cuts, further tightening global fundamentals. European diesel stocks fell below the 5-year average on lower imports from the Middle East and United States. ICE Gas oil broke above $1,000/t as the September contract expired with traders paying higher premiums for prompt deliveries.

Q4 (as of 06/12/23)

Q4 began with Hamas’ horrific attack on Israel, sparking fears of a wider conflict in the Middle East. Oil initially rose as markets spoke of “risk premium”, although the extent of this was limited and prices continued their downtrend. Attention turned to OPEC’s November meeting with expectations that production cuts would be deepened and / or extended. Rumours then emerged of divisions and markets ignored the announcement of further voluntary cuts. Focus then shifted back to the macroeconomic outlook and demand fears as China’s sovereign debt was downgraded by Moody’s credit rating agency.