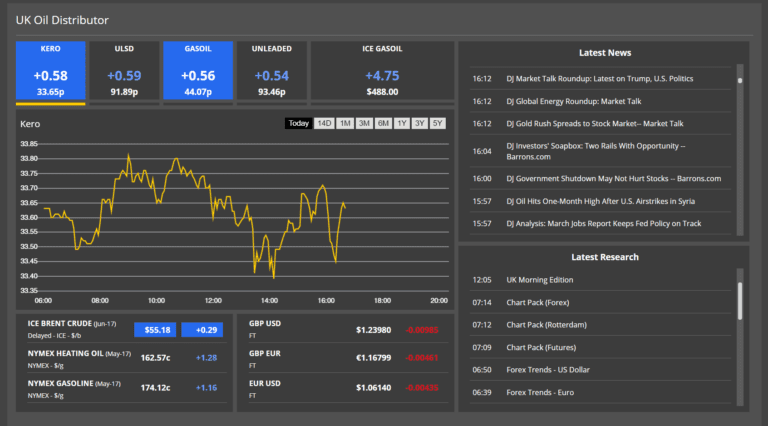

Global energy and commodity price reporting agency Argus has agreed to license its key European spot price assessments for oil products to OMJ for dissemination to OMJ’s customer base. Prices include those for gasoline, biofuels and LPG. OMJ downstream clients include large volume oil buyers, especially distributors and service stations in the UK and Ireland.

OMJ will distribute daily spot prices for a variety of internationally traded oil markets, including Argus Eurobob, the benchmark reference in short and long-term European gasoline supply contracts, and Fame, which is used to price European biodiesel supplies. Argus prices for jet fuel, diesel, fuel oil, butane, propane, ethanol and crude are also included in the agreement. In addition, OMJ will distribute Argus commodity news and analysis relevant to the UK and Irish markets.

Access to insights

“We are pleased to partner with OMJ to help increase transparency for UK and Ireland downstream customers,” Argus Media chairman and chief executive Adrian Binks said. “Evolving market fundamentals and volatility have contributed to significant price movements in recent months and OMJ’s extensive network of clients will benefit from access to our market-leading prices and insights to help them make informed decisions and manage risk.”

Ian Moore, founder and managing director of OMJ, said: “We are delighted to distribute Argus’ leading price data to our customers in response to their feedback to be able to access Argus international benchmarks through our platform. We are always keen to improve our service and the addition of the Argus prices, news and analysis to our offering is a big step forward.”

Argus was founded in 1970 and is a privately held UK-registered company. It is owned by employee shareholders, global growth equity firm General Atlantic and Hg, the specialist software and technology services investor.