EU obligations

Under EU Oil Stocking Directive 2009/119/EC, members are required to hold oil stocks at the higher of 90 days of average net daily imports or 61 days of average daily inland consumption. For the UK at present, as an oil producing country, this meant that the UK had to hold 61 days of average daily inland consumption, for both energy and non-energy use. On top of this amount, the EU required member states to discount the volume of stocks held by 10 per cent (so the UK’s stockholding obligation is, in fact, 10% more than 61 days of inland consumption).

International Energy Agency (IEA) obligations

Member countries are committed to maintain emergency oil reserves equivalent to at least 90 days of net oil imports.

So, as the higher of the two obligations, the UK’s arrangements were set with reference to the requisite days of daily inland consumption.

Post Brexit, the UK is no longer required to comply with the EU Directive, so is governed by those under the aegis of the IEA, equivalent to 90 days of net oil imports which is discounted by 25% to 67.5 days as a concession to allow for North Sea production.

Current arrangements

As a working arrangement, the UK continues to manage compliance with reference to the requisite days of daily inland consumption. The obligation is set at 67.1 days for refiners / ex refiners of net domestic consumption (61 days +10%), and 58 days for importers / wholesalers.

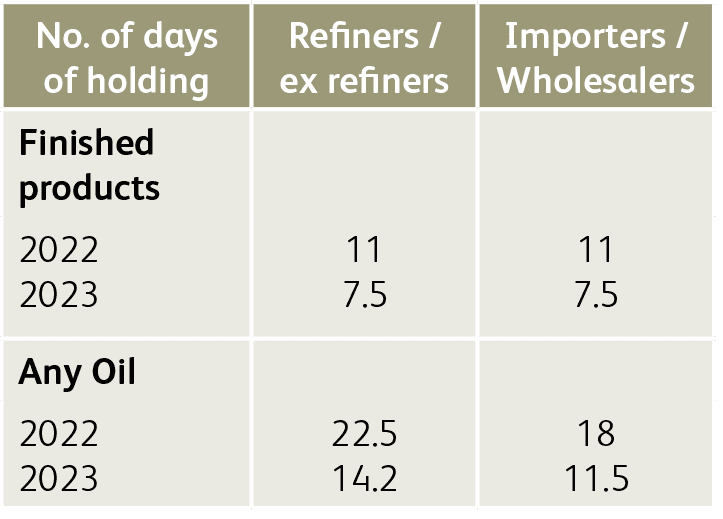

Within these over-arching obligations, there is a requirement to hold a minimum number of days of two categories of holding, which are:

- Finished products; comprising petrol, diesel/ gasoil and Jet A-1

- Any oil; comprising the full refined products’ slate, crude oil, feedstocks and NGL’s

These obligations have reduced significantly since they were first introduced in 2012 (22.5 days for finished products), primarily reflecting the impact of the covid pandemic on demand levels. The table below summarises the position in 2022 and requirement for 2023.

Monitoring of compliance is conducted (at time of writing) by BEIS (Department for Business, Energy & Industrial Strategy) on a monthly basis, from information on supply and stocking collected in the Downstream Oil Reporting System (refiners & ex refiners) and the Oil Stocking System (importers).

Although no longer in the EU, bilateral arrangements through the trading of stock tickets continue to be in place with a number of member countries, such as Germany, Belgium, Netherlands and Italy- and these are expected to remain so.

Distributors can avail of an earnings opportunity of holding, say 100 tonnes of gasoil, that can be pooled in to one larger ticket by an aggregator to be sold to a large obligated party, for which a reservation fee is paid.

Issues going forward

There are several issues which may or may not come in to play down the road, in particular:

- adoption of a different way of managing mandatory oil stocking obligations e.g. through an independent or private stockholding agency. Current examples are NORA in Ireland, CORES in Spain, SAGESS in France and EBV in Germany, where it is viewed as a cost-effective way of monitoring and managing compliance. When last considered, the then Govt opted not to pursue as, under EU rules, such a body would have to be a state-owned entity.

- move to parity of obligation over a defined and agreed time period between the two categories of oil market participant. This would be achieved through phased increases in the importer / wholesaler obligation to equate with that of refiners / ex refiners.

- how will the expected structural decline in oil products demand be reflected in the ongoing levels of obligation, mindful of the heightened focus on supply security following the Ukraine war and the likely long term loss of a key source, in the form of imported diesel from Russia?

- against a background of depleting reserves and declining production, what would be the impact of the IEA withdrawing the 25% concession for the North Sea which would increase the obligation from 67.5 to 90 days of net imports – a change which has been mooted in the past?

- can the CSO regime provide a way by which the impact of sharp seasonal volatility in demand, such as for heating oil in Northern Ireland, be mitigated by, for example, establishing a specific winter obligation for the level of kerosene holding?

While the energy transition will likely see continued reductions in CSO levels, these may well be tempered by ongoing concerns around security of oil supply. The interplay of these two factors will play a key role in determining both obligation levels and how they are managed.

ROD PROWSE, worked for 30 years across the full spectrum of the downstream oil sector, in both the UK and USA, which has included leadership position in both retail and wholesale fuels businesses. Rod draws on his extensive knowledge of this global industry to bring us ‘Industry Insights’.