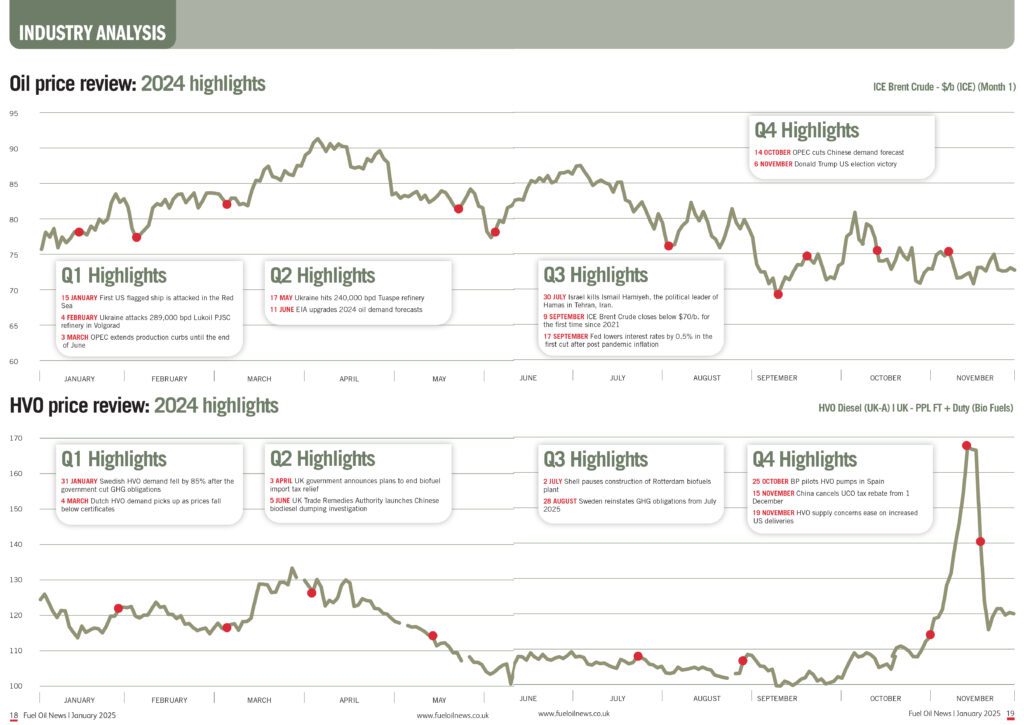

The following pages present a graph that shows how fuel prices have varied through 2024. For the first time we present data for HVO diesel alongside the Brent crude data. With data supplied by The Oil Market Journal, the markers and text boxes highlight some of the key events throughout the year that have impacted on the pricing.

We hope that it provides an interesting and insightful look back over a year which, once again, has presented those operating in the liquid fuel sector, with a broad variety of challenges.

Oil price in review

Q1

2024 was eventful for international oil prices, with much of the narrative focused on the supply side. Houthi rebels in Yemen continued to attack ships traversing the Red Sea and Gulf of Aden. Three crew personnel were killed in a missile attack, and one ship, the Rubymar, was sunk. Supply disruption impacted prices for the first half of the quarter with product diverted around the Cape of Good Hope in South Africa.

Weaker crude prices prompted OPEC+ into action again as they agreed to extend Q1 2024 voluntary production cuts until the end of Q2.

European refineries also entered planned and unplanned maintenance, while Russian refineries were targeted by Ukrainian drone attacks.

Early indications of Q1 demand suggest weakness for diesel. The German Truck Toll Index has been below the 5-year average for the quarter while manufacturing output has been performing poorly in Europe and the US.

January

Security and logistics issues in the Red Sea dominated January. Numerous cargo ships, including oil tankers, were targeted, and hit by Houthi rebels from Yemen. Product was diverted around the Cape of Good Hope to avoid attacks. In turn, this caused delays to product getting to Northwest Europe.

February

Supply distribution continued into early February. This was exacerbated by German refinery maintenance lowering domestic production. ICE Gasoil also experienced a short squeeze ahead of expiry as traders bought contracts to rebalance their positions. Following expiry, prices moved downward for middle distillates as product made its way to Europe and stocks began to replenish, exacerbated by weaker demand.

Petrol prices performed well ahead of the seasonal transition with fundamentals remaining tight.

March

Lower crude oil prices pushed OPEC+ into action once again. They decided to extend their voluntary production cuts until the end of Q2 2024. Revised supply and demand forecasts from OPEC, the US EIA, and the IEA all suggested a supply and demand deficit in 2024, which has led to upward pressure on oil prices.

Ukraine also increased its attacks on Russian refineries with Reuters reporting that about 14% of Russia’s oil refining capacity has been taken offline for repairs.

Q2

Geopolitical tensions continued into Q2, with conflict in the Middle East on markets’ minds. Ukraine continued to attack Russian oil refineries, but not to the same extent as in Q1. The large 240,000 bpd Tuaspe refinery was hit on 17th May, which had only just restarted following previous drone strikes. Drones also hit the 70,000 bpd Slavyansk refinery on May 18th–19th, forcing it offline. All in all, 12 refineries or storage areas were targeted in May, albeit most remained at least partially operational.

Despite European and US refineries entering a period of maintenance and Russian refinery outages, oil prices remained subdued on weaker demand and ample supply. Diesel barges began trading at discounts to front month futures as early as 4th April with ICE Gasoil M1 flipping to contango on 17th April.

At the start of June OPEC extended voluntary production cuts for another quarter and involuntary cuts until the end of 2025. Prices began rising again. ICE Gasoil flipped back into backwardation from its slight contango.

April

The beginning of the quarter was volatile. Iran and Israel each launched missile and drone strikes on each other, with markets fearing supply disruption. Prices, however, fell once markets came to realise that no supply disruption would materialise. ICE Gasoil occupied a tight range between $740/t/. and $750/t. with weak fundamentals and macroeconomic indicators keeping prices capped.

May

Oil prices were stable in May, with main futures and spot pricing remaining largely rangebound with little geopolitical news or shifts in fundamentals to drive any meaningful volatility.

Oil inventories in the ARA storage hub continued to build with demand muted and the middle distillate market flipping to a slight contango in April. Markets began awaiting OPEC’s decision on output, due to take place on 2nd June.

June

OPEC agreed to extend voluntary cuts by another quarter to September 2024, whilst also extending involuntary cuts until the end of 2025. Voluntary cuts would then be phased out from October 2024 onwards.

Oil prices began rising following OPEC’s decision, despite an initial fall. Market expectations were that the oil market would be in a structural deficit for the rest of the year, which led to upward pressure in prices towards the end of June.

Q3

Q3 2024 was dominated by fears of global economic slowdown and an increased prospect of lower interest rates.

In July, Chinese GDP growth was lower than expected which ignited concerns over global oil demand with prices falling in turn.

August saw weak US payroll data and the largest downward revisions to historical data in 15 years. This led Fed Chair Powell to declare that the ‘time has come’ to cut interest rates with the Fed lowering interest rates by 0.5% in September.

OPEC announced that it was extending production curbs until October and then extended curbs until December when prices weakened further.

Libya banned oil exports over a central bank dispute between rival governments. Tensions continued to rise in the Middle East with Israel attacking Hezbollah communication devices and assassinating its leader in Lebanon in September.

July

July was turning into a weak month until the final few days. ICE Gasoil fell below $800/t. before testing $700/t. and recovering slightly higher. Brent Crude also fell to $80/b., which is turning into a very strong support level. Chinese GDP growth was lower than expected at 4.8%, which had sparked some fears of global oil demand growth, dragging on prices.

Geo-political tensions led to upwards moves on the last trading day of the month as Israel killed Ismail Hamiyeh in Tehran. The move sparked fears of an escalation to wider conflict in the region. US president Joe Biden dropped out of the US presidential election and was swiftly replaced by his current Vice President Kamala Harris.

August

Oil prices were mixed in August, with US payrolls for July and a large historical revision causing Fed Chair Jerome Powell to announce that ‘the time has come’ to cut interest rates. However, prices were supported by the Libyan ban on oil exports in a row between rival governments over the central bank. The US DoE agreed to buy 2.5 mb of crude for the Bryan Mound SPR facility with delivery in Q1 2025.

September

September started with an underwhelming US driving season ending and the IEA downgrading Chinese demand due to ‘broadly based slowdown’. ICE Brent Crude dipped below long-term resistance of $70/b. before oil prices found support in the middle of the month.

Storm Francine shut in over 730,000 bpd of US Gulf Coast Supply, the Fed kickstarted the rate easing cycle with a 0.5% cut.

Israel’s attack on Hezbollah communication devices and execution of its leader in Lebanon escalated tensions in the Middle East.

Saudi Arabia indicated that it would prioritise market share over a target price in a hint that it will increase production.

October

October began with increased tension in the Middle East, as Iran launched a missile attack on Israel on 1st October. However, prices lowered as Libyan crude supplies increased after the temporary export ban.

Prices fell further as Israel launched a smaller attack than expected at the end of the month.

Chinese demand concerns continued with further weak economic indicators. Inflation fell at a faster rate than forecast and Q3 GDP growth disappointed. Hedge funds continued to sell, reducing their net long positions of all products in the final week of the month.

November

November got off to a bullish start as the US re-elected Donald Trump in the presidential election. OPEC delayed production curbs for an additional month until January 2025. ARA oil stocks were depleted early in the month with gasoil at a 14-week low on 7th November.

The conflict in Ukraine escalated further with Biden sanctioning the use of long-range missiles against Russia. The IEA and OPEC’s revised demand growth lower for 2025. Chinese economic fears continued with industrial production lower than expected and crude runs falling by 7% on the year in October. Israel agreed a ceasefire with Lebanon, de-escalating Middle East tensions.

Oil price review: 2024 highlights

January

12 IS warned that if the UK and US navies attack Yemen “we will attack Americans”

15 First US flagged ship is attacked in the Red Sea

February

4 Ukraine attacks 289,000 bpd Lukoil PJSC refinery in Volgorad

March

3 OPEC extends production curbs until the end of June

12 EIA forecasts supply deficit for 2024

April

4 Israeli strike on Iranian embassy kills 3 generals

17 ICE Gasoil enters contango

May

17 Ukraine hits 240,000 bpd Tuaspe refinery

June

2 OPEC extends production curbs until 30 September

11 EIA upgrades 2024 oil demand forecasts

July

4 ARA Jet Kero stocks at 3 year high

10 Chinese inflation falls to 0.2% prompting fears of economic slowdown

11IEA warns Chinese oil demand growth “pre-eminence is fading”

16 Chinese GDP grew by 4.8% which was lower than expected

30 Israel kills Ismail Hamiyeh, the political leader of Hamas in Tehran, Iran.

August

2 Weaker than expected US non-farm payrolls with large downward revisions

13 DoE agrees to purchase 2.5mb of crude for the Bryan Mound SPR

23 Fed Chair Jerome Powell declares ‘the time has come’ to lower interest rates

27 Libyan oil production shutdown amid government dispute over central bank chief

September

1 US driving season ends

9 ICE Brent Crude closes below $70/b. for the first time since 2021

11 Storm Francine shut in over 730,000 bpd of US Gulf Coast Supply

12 IEA downgrades global oil demand forecasts primarily because of China

17 Israel detonates explosions in 3,000 Hezbollah pagers in Lebanon

17 Fed lowers interest rates by 0.5% in the first cut after post pandemic inflation

26 Saudi Arabia indicates that it will prioritise market share rather than a price

October

1 Iran strikes Israel in large scale missile attack

2 OPEC extends production curbs for 2 months until December

3 Libya reopens oil fields

14 OPEC cuts Chinese demand forecast

17 Israel killed Hamas leader Yahya Sinwar

21 China GDP growth lowest in 18 months

25 Israel carries out a limited air strike on Iran

November

4 OPEC delays curbs until Jan 2025

6 Donald Trump US election victory

19 Ukraine fires US long range missiles in Russia

26 Biden announces Israel/Lebanon ceasefire

HVO price in review

Q1

HVO began the year with falling premiums to ICE Gasoil amid a well-supplied market that was struggling to compete with low certificate costs across Europe.

Cheap certificates disincentivised blending which reduced demand for HVO. Matters were exacerbated when the German government announced delays to unrestricted HVO100 sales which had been due to commence in April 2024.

January

Amid uncertain government policy, German HVO demand fell in January to the lowest level since February 2023. Meanwhile, Swedish HVO demand fell by 85% on the year in the wake of government cuts to GHG obligations, emphasising the connection between government policy and HVO markets.

February

On 2nd February, Class IV HVO prices rose for the first time since September 2023 after 5 months of stagnation. On 23rd February, Cepsa began construction of a new HVO plant in Spain with capacity for 500,000t of output per year.

March

Q1 ended on a bullish note as demand picked up. Demand was primarily driven by the Netherlands where HVO fell below certificates which led to increased blending. On 22nd March, Germany voted to allow HVO100 sales at public pumps form 13th April 2024.

Q2

Q2 began with the UK government announcing plans to end biofuel import tax relief. This policy decision would in turn push up HVO prices domestically.

April

On 18th April, the German government announced a further delay to HVO sales amid mixed government communications.

May

The eventual decision to allow sales of HVO100 in Germany was made by the end of May.

June

In June, the UK Trade Remedies Authority (TRA) Launched an investigation into Chinese biofuel dumping. At the end of June, Neste struck a deal in the first of its kind to supply Dutch cruise ships with renewable diesel.

Q3

July

On 1st July, the French government approved the sale of HVO100 to the public, which began the third quarter on a bullish note. However, the following day, Shell paused construction of its biofuel plant in Rotterdam amidst concerns over the profitability and sustainability of the venture.

In mid-July the EU announced provisional anti-dumping duties on Chinese biofuels. The announcement supported prices on increased fears over long-term supplies. In July Swedish HVO deliveries increased by 60% on the year.

Meanwhile biofuels accounted for 7.5% of the total UK fuel mix during the year to date which was below 8% in the same period the previous year.

August

In August, the EU delayed its final decision on Chinese anti-dumping duties. On the 28th August, Sweden re-instated GHG obligations from July 2025 in a move that reversed earlier reductions.

HVO was lifted in the final days of the month with ICE Gasoil.

September

In September, the UK TRA announced that it would push back the timeline of its Chinese anti-dumping investigation which created uncertainty over government policy direction.

By mid-September, HVO prices were being weighed down by ICE Gasoil losses. Falls extended when a German draft law proposed that certificates could not be carried into next year. This meant that they must be used by the end of the year or be lost. In practical terms there was a decrease in physical blending which pushed back demand.

Q4

HVO prices began to lift in Q4 as market participants placed value on the lower cold filter plugging point of HVO ahead of the winter months.

The UK Renewable Transport Fuel Association (RTFA) filed complaints with the TRA over the use of Malaysia as third country in UK investigation. The RTFA argued that Malaysia also has distortions in its own domestic market and that Brazil would be a more suitable comparison given broader similarities to China in terms of societal development.

October

At the end of October, BP launched a pilot of HVO100 pumps across Spain.

November

November was an extremely volatile month with major supply disruptions.

On 7th November, Eni’s biorefinery in Sicily was taken offline for maintenance. The next day, Neste’s Rotterdam refinery was taken offline after a major fire broke out. On the same day, TotalEnergies closed its La Mede biofuel plant for repair works. This caused prices to spike with the price of Argus HVO Class II settled on 13th November at $2,452.54/t. compared to $2,037.95/t. on 7th November.

On 15th November, China announced the end of its UCO tax rebate from 1st December. On 18th November, the Netherlands retrospectively increased its 2024 GHG reductions which increased demand alongside ongoing major supply disruptions. By 19th November, HVO supply concerns were beginning to ease on the back of increased deliveries from the USA. Argus HVO Class II settled on 21st November at $1849.22/t.

Insert price graph image

HVO price review 2024 highlights

January

12 HVO premiums to ICE Gasoil drop amid a well-supplied market

23 Germany to delay unrestricted HVO100 sales which had been due from April

31 Swedish HVO demand fell by 85% after the government cut GHG obligations

31 German HVO demand fell to lowest since February 2023

February

2 Class IV HVO rose despite ICE Gasoil for the first time since September 2023

23 Cepsa start construction of 500,000t per year HVO/SAF plant in Spain

March

4 Dutch HVO demand picks up as prices fall below certificates

22 Germany allows HVO100 at public pumps from 13 April 2024

April

3 UK government announces plans to end biofuel import tax relief

18 Germany delays HVO100 introduction

May

28 German HVO100 is approved

June

5 UK Trade Remedies Authority launches Chinese biodiesel dumping investigation

27 Neste to supply renewable diesel to Dutch cruise ships

July

1 France approves HVO100 for sale

2 Shell pauses construction of Rotterdam biofuels plant

19 EU announces provisional anti-dumping duties on Chinese biofuels

31 Renewable fuels made 7.5% of UK mix Jan-Jul 2024 v 8% in 2023

31 Swedish biofuel deliveries up 60% on the year

August

12 EU delays final decision on Chinese anti-dumping duties

28 Sweden reinstates GHG obligations from July 2025

29 HVO prices rise with ICE Gasoil

September

5 UK pushes back timeline on Chinese biofuels investigation

10 HVO prices weighed down by ICE Gasoil

20 German draft law proposes no certificate carryover

October

7 HVO premiums rise as participants value the lower cold filter plugging point

21 Renewable Transport Fuel Association (RTFA) files complaints over use of Malaysia as third country in UK investigation

25 BP pilots HVO pumps in Spain

November

7 Eni’s biorefinery in Sicily is taken offline for maintenance

8 Neste’s Rotterdam refinery offline after fire breaks out

8 TotalEnergies closes La Mede biofuel plant for works

8 UK announces extension of duties on Argentinian biofuels

15 China cancels UCO tax rebate from 1 December

18 Netherlands retrospectively increases 2024 GHG obligations

19 HVO supply concerns ease on increased US deliveries

Data and analysis provided The Oil Market Journal, provider of energy prices, fundamental data, news and analysis for oil distributors and traders, service stations, bunkers traders, shippers, large volume commercial and industrial buyers. You can find out more and request a free trial by visiting https://www.the-omj.com/

Image from Dreamstime