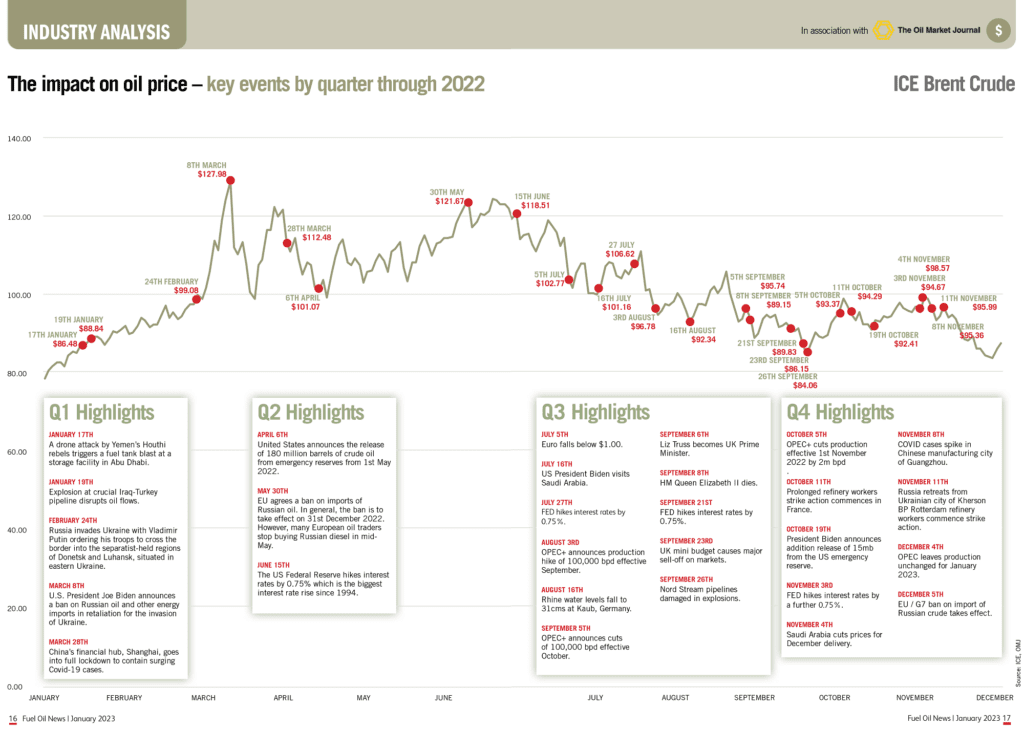

Contained within this article is a graph which shows the price of Brent Crude throughout 2022. With data supplied by The Oil Market Journal, the markers highlight some of the key events throughout the year that have impacted on the pricing. We hope it provides an interesting look back over a year which, once again, presented unforeseen and unpredictable challenges. Originally published in our January issue the graph can also be viewed in the PDF of the magazine here.

At the time of writing, in mid- December, the Brent crude oil price was recovering from a downward trajectory fuelled by growing fears of a global economic recession. A price around 80 US dollars meant that, despite a year of highly unpredictable volatility, the price at year end was not dissimilar to that at the end of 2021.

In March 2022, oil prices had soared to highs not seen since 2008 as a result of the Russia-Ukraine war but, from June onwards, the trend has been almost entirely downward with the price, driven by market uncertainty, finally hitting the lowest levels for the year in December.

Ukraine crisis dominates

2022 was overshadowed by the devastating invasion of Ukraine by Russia. President Putin has exposed himself for what he is, an evil dictator. He has sealed his place in history as one of the most depraved world leaders, joining Hitler and Stalin.

Martin Luther King Junior said: “The ultimate measure of a man is not where he stands in moments of comfort and convenience, but where he stands at times of challenge and controversy.”

The invasion of Ukraine has exposed both good and evil, the weak and strong.

Ukrainian President Zelenskyy has surprised the world with his courageous leadership and like, President Ronald Reagan, has made the transition from acting to leading a nation with great skill.

Other leaders, such as Estonian Prime Minister Kaja Kallas, who lives under the shadow of Russia and whose family has experienced much of Russian terror, has taken a brave stand. She has been vocal in calling on fellow European nations to take decisive action against Russia. Italy too, a nation with close economic links to Russia, “has risen to the occasion.”

However, others have fallen short, such as the Hungarian premier Victor Orban who appears to be struggling to free himself from the embrace of Putin.

Future concerns

The Ukrainian crisis will likely dominate the headlines for many months and perhaps years. The fall out for oil markets still remains unclear but diesel tightness seems certain. Natural gas prices blew-out in the second half of 2021, followed by ICE Gas Oil in March 2022.

However, our fear is that the next blow-out on futures markets will be for agricultural crops. That could cause serious problems for nations with large populations to feed. Concerns over food security perhaps explains why India and China have failed to condemn Russia.

Hunger for oil is one thing, but hunger for food is much worse.

Q1

With demand having risen unexpectedly in Q4 2021, against a backdrop of chronic underperformance by OPEC+ in meeting output targets, the year began with oil prices moving higher. Russia’s invasion of Ukraine in late February caused a global shock with the grave human implications impacting markets. With Russia a key producer of several important commodities including oil, gas, and wheat, prices of these soared as supply chains were disrupted. The oil price was somewhat tempered by renewed Covid-19 outbreaks in China leading to new lockdowns in some major cities and impacting demand.

With international sanctions against Russia depressing global economic growth and supply concerns mounting, the oil price hit its highest point towards the end of Q1 reaching 127 US dollars.

Q2

Although oil prices were once again volatile in Q2 it is interesting to note that the ICE Gas Oil Future ended Q1 2022 at $1060.75/t. and ended Q2 2022 at $1060.00/t. During the quarter fears over the loss of Russian diesel supply were largely offset by growing concerns that the world and especially Europe was heading into a recession.

There were also signs of demand destruction. At the end of the quarter US distillate demand was down 7.4% on the previous year and US gasoline demand was down 2%.

Product stocks remained very low and historically there has been a close correlation between stocks and prices. Therefore, although demand growth was weakening, there was no expectation of any major correction lower until stocks increased.

Q3

In the nine months prior to 30 September 2022 Brent Crude prices increased by 13.09%. The Saudi Energy Minister claimed this was because of the good management of the market by OPEC+.

However, it was due to the massive release of 180m barrels from the US emergency reserve.

During the same period ICE Gas Oil increased by 48.91%, which reflected the market reality without emergency stocks to help. Q3 ended with the sabotaging of the Nord stream pipelines, bringing increased geo- political risks to a once stable Europe.

The weakness of Sterling attracted a lot of attention especially in the week after the UK mini budget. However, the Yen has been the biggest loser this year v the US Dollar with the Yen down 25.7%.

www.the-omj.com/research/yearbook