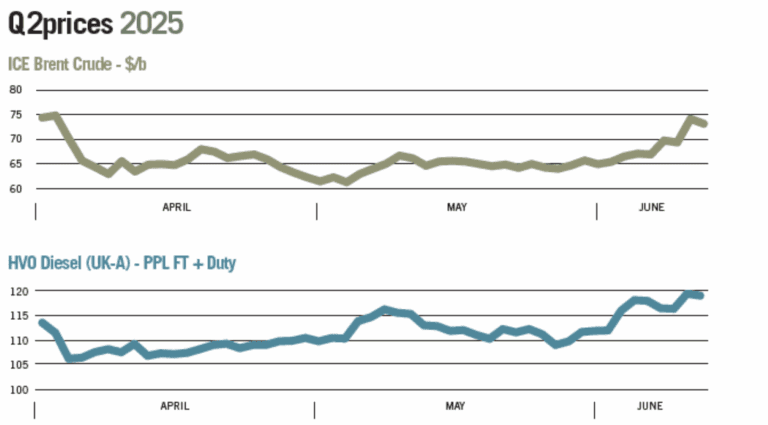

A quarterly review of the movements of, and impacts on, brent crude and HVO diesel prices. With data supplied by the Oil Market Journal, we highlight some of the key events that have impacted pricing over the quarter.

Q2 2025

Quarter 2 was dominated by the dramatic economic fallout from the US’ ‘Liberation Day’ tariffs and the implementation, by OPEC, of three substantial increases in production quotas. As any novice economist will know; lower demand and increasing supply will lead to lower prices. These factors led to a bearish market sentiment, with Brent crude oil prices dropping below $60/b to a four-year low. The prospect of trade deals, alongside a renewed focus on conflict in both Ukraine and the Middle East, saw prices largely recover losses in the first weeks of June.

April

The 1st of April is widely known as April Fools Day, however, in 2025, 2nd of April was no joke for the global economy, as the trade rules of the last 80 years were upended. US President Trump announced his global ‘reciprocal’ tariffs on what he called ‘Liberation Day’ with tariffs against all nations on earth, including the uninhabited Heard and McDonald Islands, home only to a penguin colony.

If tariffs were to choke global oil demand, the following day saw the first of many increases to global supply as OPEC announced a significant 411,000bpd increase to production quotas for May. The combined effect saw ICE Brent Crude fall 10% over two days to $65.58/b. The next week brought further market chaos, as Trump announced 104% tariffs against China on 8th April, which were responded to with 84% tariffs and Crude fell below $60/b. for the first time in over four years.

A week from the initial announcement, Trump announced a 90 day pause to the reciprocal tariff rate, and instead, opted for a global base of 10% amid falling stock, dollar and oil markets and soaring treasury yields around the world in reaction to Trump’s economic policy. However, the trade war embargo against China deepened, with 145% tariffs announced by the US, and 115% announced by China. The IEA and OPEC both announced downward revisions to oil demand forecasts amid the economic fallout.

On 16th April, US Federal Reserve Chair, Jerome Powell, warned of the negative impact of tariffs on the US economy. Unsurprisingly, this was displeasing to Trump, who then threatened to fire Powell from his role, despite not having the constitutional power to do so. The continued threat of such a move saw yet more global angst, as an independent central bank is key to maintaining confidence in inflation expectations.

In time, Trump eventually stood back from said threats. OPEC discipline was called into question as Kazakhstan’s new Energy Minister, Erlan Akkenzhenov, said that Kazakhstan would prioritise national interests when deciding on oil production, rather than OPEC. “To act in accordance with national interests. This is a broad formulation, but it completely covers the entire situation that we have now. Act only in accordance with national interests,” the minister said.

The news came amid an ongoing dispute within OPEC, as Saudi Arabia tried to put pressure on Kazakhstan over rising oil production which is surpassing OPEC quotas. Saudi Arabia indicated it could “live with lower prices” and OPEC+ would consider accelerating its oil output increases in June. April drew to a close with the announcement that Q1 2025 brought the first US GDP quarterly contraction since 2021.

May

May began with another 411,000bpd increase to OPEC production quotas for June. OPEC’s internal tensions and back-to-back increases saw prices fall further and drowned the risk premium from Middle East conflict. The 4th May saw a missile attack on Ben Gurion airport in Israel carried out by Houthi rebels. This was followed up by joint US and Israeli airstrikes on Houthi targets in Yemen, however, on 5th May, ICE Brent Crude closed at a year-to-date low of $60.23/b.

Momentum soon began to change with the announcement of a UK-US trade deal on 8th May. While not the largest trade agreement in the world, markets were relieved to finally see Trump at the negotiating table. That weekend US and Chinese trade representatives met in Switzerland and on Monday 12th May, the two nations reduced tariffs to 30% and 10% respectively in a 90-day truce to allow further trade discussions.

Oil markets tightened throughout May, on reduced stock with kerosene reported to be at short supply in Grangemouth in mid-May. May saw European stocks in the ARA hub fall below the 5-year average for the first time this year, across all products, and by 23rd May, US distillate stocks had fallen to the lowest level since March 1990. Despite tightening fundamentals, oil futures did not break above key resistance levels on speculation of further OPEC production increases and further insubordination from Kazakhstan’s government. On 31st May, OPEC agreed another 411,000bpd increase for July.

June (as of 16th June)

June saw attention turn back to the long running conflicts in both Ukraine and the Middle East. Prices rapidly recovered losses made since Liberation Day, amid fresh geopolitical risks. On 1st June, Ukraine launched an audacious drone attack on Russian military airports and destroyed at least 40 Russian warplanes. The destroyed aircraft were at military bases deep inside Russia, including Belaya, which is closer to Japan than Ukraine, and Olenya, which is in the Artic Circle.

The action offset bearish sentiment following the OPEC decision the previous day to hike production. Natural disaster also struck in Canada, when the Caribou Lake Fire in northeast Alberta multiplied to 62,000 hectares (152,000 acres), threatening oil sands projects on both the north and south ends.

In the early hours of Friday 13th June, Israel launched air strikes on Iranian nuclear facilities which has led to a continuing escalation of tensions on the region. Each Iranian retaliation has been met with a stronger Israeli response, and Iran has had several top military leaders and nuclear scientists killed. Global oil prices rocketed in immediate response, with ICE Gasoil futures smashing through resistance of $700/t. Thus far the US has not been directly involved, however, any indication of a broader regional conflict and disruption to oil flows would doubtless send prices higher.

BIOFUELS

April

Biofuels began the quarter dragged by the same economic shocks impacting oil markets. Biofuels recovered when tariffs were paused, with HVO prices lifted further by increased bidding interest. BP paused plans that would increase clean jet fuel production capacity at its Castellon refinery in Spain, amid weak market growth. On 22nd April, the UK Trade Remedies Authority recommend continuing current anti-dumping duties on Argentinian biodiesel imports.

May

The UK-US trade deal announced on 8th May, opened UK markets to US ethanol exports. Under the deal, the UK would expand market access to US ethanol, creating $500 million more in US exports, the White House said. This has since led to Vivergo Fuels just outside of Hull in East Yorkshire to warn of is potential closure if high volumes of US ethanol arrive in the UK. Biofuels manufacturer Ensus has warned it faces imminent closure because of the trade deal.

On 22nd May, Greenergy announced that it will temporarily pause production at its Immingham biodiesel plant, citing ongoing viability challenges in the UK biofuel market. Rising certificate costs contributed to increased physical blending and a spike in biofuel demand, with HVO Class II and IV premiums to ICE Gasoil at 6-month high by 23rd May.

June (as of 16th June)

On 3rd June, Swedish refiner Preem’s Gothenburg refinery’s International Sustainability and Carbon Certification (ISCC) was suspended for HVO production, at a time when HVO markets were already tight. While prices did not spike as significantly as after the fire at Neste’s biorefinery in Rotterdam last November, the increase has still been considerable. Other biofuels used in diesel blends have seen already high demand exacerbated by HVO issues with FAME0 reaching the highest price in 2 years by 9th June. All biofuel prices have been lifted further by increased tensions in the Middle East.

Q2 2025 Key dates

April

2 Liberation Day tariffs

3 OPEC increases quotas by 411,000bpd

8 104% tariffs on China

9 China announces 84% tariffs on US

9 90 day tariff suspension for all nations apart from China

10 US tariff on China confirmed at 145%

11 China announces 125% on US

14 OPEC cuts demand forecast

15 IEA cuts oil demand forecast

17 Trump threatens to fire Fed Chair Powell

22 UK TRA to keep duties on Argentina

23 Kazakhstan defies OPEC, oil production in ‘national interest’

30 US GDP -0.3% in Q1

30 Saudi could ‘live with lower oil prices’

May

3 OPEC agrees 411,000bpd hike in e, Brent below $60/b

8 UK-US trade deal

12 US-China tariff truce

20 Greenergy temporarily closes Immingham biodiesel plant

29 US distillate stocks at lowest since March 1990

29 Kazakhstan tells OPEC it will not cut production

31 OPEC agrees 411,000bpd increase in July

June

1 Ukraine strikes Russian aircraft in drone attack

2 Canadian wildfires

3 Preem’s Gothenburg biorefinery ISCC certification suspended

9 FAME0 at 2 year high

13 Israel-Iran air strikes

All data and analysis provided by The Oil Market Journal.

To find out more and request a free trial: +44 (0) 28 6632 9999

info@the-omj.com

www.the-omj.com

Image credit: The Oil Market Journal