With data supplied by The Oil Market Journal, we will highlight some of the key events that impact pricing.

Q1 2025

2025 began with supportive sentiment as markets awaited the expected pro-business agenda of President Trump. However, markets were soon hit by a combination of tariff uncertainty, US repositioning on Russia/Ukraine, ARA stock build and US recession fears. After early rapid gains, Q1 brought sharp losses to oil, the US dollar and stock markets, amid extreme trade and geopolitical uncertainty as the post WW2 world order came under unprecedented strain.

January

January got off to a bullish start as Biden announced, in his final days in office, further sanctions on Russia with the IEA warning of a tightening of crude markets as a result. Demand was bolstered by an extreme cold snap in the US and cold weather across NWE.

Peace prospects in the Middle East increased when Israel and Hamas announced a ceasefire days before Trump took office amid strong threats from the president-elect. Donald Trump was inaugurated for a second term as US President on 20th January. During his inaugural address he repeated his ‘drill baby, drill’ phrase and promised to unleash a new era of US crude production.

Market downside was limited as the first of what was to become many tariff announcements was soon made against Canada and Mexico. Trump appeared at the Global Economic Forum in Davos and demanded that OPEC increased production to reduce oil prices which would in turn lower inflation and allow central banks to ease interest rates.

February

February was dominated by the ‘will-they-won’t-they?’ of US trade tariffs. The first tariffs promised were suspended for 4 weeks on 3rd February. The month saw countless tariff threats against US trade partners; however, none came to fruition following last minute negotiations between governments.

US consumer confidence fell in February, in the single largest fall seen since 2021, as a direct result of tariff uncertainty.

In further bearish news, ARA gasoline stocks hit a record high in early February highlighting the issues faced by European refineries as the Dangote refinery progresses towards full production in Nigeria. The new refinery will dominate the African market, a traditional export destination for European refineries. The first jet kero tanker sailed through the Red Sea since the start of the Houthi attacks, easing European supplies. US crude stocks also rose sharply, increasing by 8.7 million barrels in a single week.

Another major development in February was the reorientation of the US towards Russia in the Russia/Ukraine war. On 12th February Donald Trump had a phone call with President Putin of Russia.

US VP JD Vance went on to lambast European democracies at the Munich Security Conference which was swiftly followed by a meeting of US and Russian officials to discuss a peace agreement in Ukraine. However, Ukraine was not represented at the talks. The US voted against a UN motion condemning Russia for its invasion of Ukraine.

Ukraine’s President Zelensky visited the White House on 28th February to sign a pre-agreed minerals deal. The visit was cut short when an interview in the Oval Office descended into a disturbing row triggered by an apparent disrespect caused by Zelensky’s Churchill style wartime attire and an accusation by JD Vance of a lack of gratitude towards the US for its support.

The overall impact of the US turn from its traditional European allies towards Russia was that the perceived likelihood of a ‘peace at any cost’ agreement in Ukraine and the potential for unfettered Russian oil flows spooked markets further.

March (as of 14th March)

March continued on a similar bearish trajectory with increasing concern over the lack of coherent US trade and foreign policy. Tariff threats and counterthreats were traded before the first implemented (at the time of writing) tariff was enacted with a 25% tariff on steel and aluminium from all nations.

On 3rd March the US paused intelligence cooperation with Ukraine.

March brought hope of a European economic revival as Germany announced intentions to alter the constitutional debt break to unleash defence and infrastructure spending. On the same day, the EU proposed up to €800 billion for increased defence spending as the continent faced the prospect of an uncertain partner in the White House.

US energy policy also developed as the Energy Secretary announced his intention to refill the SPR reserves and also that the US seeks ‘lower’ oil prices but would not specify a figure.

March brought renewed concerns of recession in the US with an Atlanta Fed model predicting Q1 GDP contraction on 4th March. Matters were not helped when Trump failed to rule out a recession in a friendly interview on Fox News, a channel on which he and other members of his administration regularly appear.

US NFIB Small Business Optimism Index wiped election gains as traditionally Republican small business owners grew tired of uncertain trade policy. Meanwhile the S&P 500 officially entered a correction having lost 10% value in just three weeks.

The weakening global markets passed onto wholesale prices and forecourt pump prices with the week ending 9th March seeing the weekly average fall in UK B7 and E10 retail prices since September.

Biofuels

Biofuels got off to a poor start, dragged by ICE Gasoil. However, prices soon found support as on 9th January the EU formally adopted the Anti-Dumping Directive against Chinese origin biodiesel.

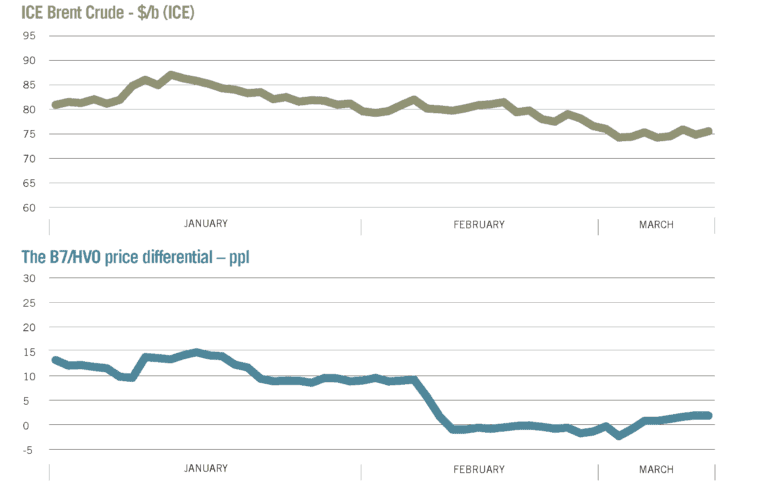

In February, strong HVO supplies to the ARA hub saw premiums to ICE Gasoil fall sharply while the spot/swap premium fell to $25.53/t on 20th compared to $142/t on 15th January. The HVO premium to blended ULSD FAME-10 rocketed in Q4 2024 on a number of supply issues.

This premium had largely eased by January, beginning the year 13.18ppl above B7. The correction continued in Q1 and by 14th February HVO was at a discount to B7 diesel and remained below the B7 price until 7th March.

All other biofuel premiums to ICE Gasoil rose sharply as Gasoil weakened. UCOME prices briefly came under pressure from low HBE ticket prices which reduced physical blending. On 12th February Neste announced that it was pausing investment in its Rotterdam biorefinery.

There was a global disincentive to invest in biofuels, largely driven by policy in Washington. Other oil majors, such as BP, announced reductions in biofuel investments. UCOME prices continued to find support in the wake of the removal of Chinese rebates on UCO exports. #

Chinese tariffs on Canadian rapeseed exports brought bearish sentiment to RME in March. RME is the primary feedstock in FAME-10.

All data and analysis provided by The Oil Market Journal.

To find out more and request a free trial: +44 (0) 28 6632 9999 info@the-omj.com www.the-omj.com

Q1 Prices 2025

insert graph image here – align centre

B7 Diesel (Blended ULSD FAME-10) is 87.84% ULSD 10ppm UK + 12.16% FAME-10 (RED) + 0.850ppl development fuel + $20/t shipping.

The Argus HVO Class II price in pence per litre is converted from tonnes to litres using a conversion rate of 1282, and into sterling using the FT exchange rate. The HVO price in ppl for road diesel and off-road diesel includes the value of two non-crop certificates and duty.

Q1 2025 Key dates

January

- 9 EU approves Chinese biofuel Anti-Dumping Directive

- 10 US announces further sanctions on Russia

- 13 Cold weather over US & NWE

- 15 Israel Hamas ceasefire

- 16 ARA gasoline stocks hit record high (and continue to throughout January)

- 20 Trump inauguration, drill baby drill, tariffs for Canada, Mexico and China from 1

- 23 Trump demands OPEC lower oil prices and banks cut interest rates

- 29 Ukraine attacks 317,000 bpd Lukoil NORSI refinery in Kstovo.

February

- 3 US tariffs delayed

- 6 ARA petrol stocks record high

- 7 Jet tanker through Red Sea, Sing fuel oil crack positive first time in 5 years

- 12 Trump calls Putin

- 12 Neste delays Rotterdam biorefinery

- 17 US Russia talks in Saudi Arabia

- 21 US consumer confidence largest fall since 2021

- 24 US votes against UN motion condemning Russia

- 28 President Zelensky visits White House

March

- 3 US aid to Ukraine paused

- 4 Atlanta Fed model predicts Q1 contraction

- 5 Germany to alter constitutional debt brake

- 5 EU announces €800 billion of defence spending

- 7 US Energy Sec to bid for funding to fill SPR

- 9 UK B7 & E10 retail pump prices see first fall since September

- 10 US energy secretary targets ‘lower’ oil price

- 10 Tanker fire in North Sea

- 11 US NFIB Small Business Optimism Index wipes election gains

- 13 S&P 500 down 10% in 3 weeks, enters official correction

Image supplied by OMJ