search | tax

...significant safety and environmental issues. As taxpayers and local ratepayers, not only are we missing out on the stolen tax that ends up the pockets of the criminals, we are...

...operation typically generates tonnes of toxic waste, which involves significant environmental and safety issues. As taxpayers and local ratepayers, not only are we missing out on the stolen tax going...

...Ross, raises concerns around the potential pollution risks involved. “As taxpayers and local ratepayers, not only are we missing out on the stolen tax that ends up the pockets of...

...subject to the Mineral Oils Tax. This decision now needs to be followed with a clear understanding of how biofuels could, and should, contribute to Ireland’s overall decarbonisation of heating....

...taxi’, getting my daughter to her dad’s for breakfast and my son to his secondary school and then I will make my way to work to start for 8.30am. As...

...red diesel and increased demand for white. On April 1 2022, the Government changed the rules on who is eligible to use red diesel – with the aim of taxing...

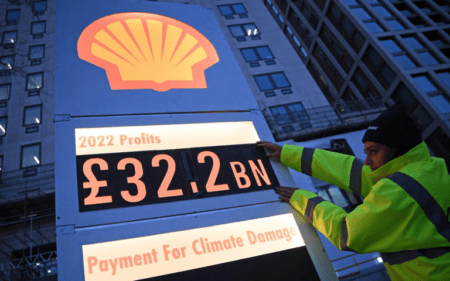

...are not encouraged by the government to invest in decarbonising our energy infrastructure and systems. Instead, she said: “It is the opposite. For example, the much debated ‘windfall tax’ on...

...and North Sea sources.” Deferred tax payments cleared Increased demand for locally produced fuel amidst the tight global supply situation has seen trading significantly ahead of previous forecasts. This stronger...

...or deliverability but that means a huge investment. Does the windfall tax affect that ability to invest in future solutions? Currently the windfall tax is only applicable to companies extracting...

...vehicles on hydrotreated vegetable oil (HVO). Crown Oil, based in Bury, has now called on the UK government to introduce tax relief on fuels such as HVO to encourage greater...

...short amount of time would impose immediate additional tax of significant value for many industries – and in industries that are already operating on reduced margins due to Covid-19 restrictions...

Two men from Great Yarmouth were arrested last week after HMRC dismantled a diesel laundering plant, capable of evading over £1.3 million in duty and taxes a year. Storage tanks,...

...FY15. Profit after Tax (PAT) in the period grew to $244 million, against $70 million in FY15. “This was a good year for the business, with the strong financial and...

As an oilfield tax allowance paves the way for hundreds of new jobs in the UK, the Oil and Gas Global Salary Guide 2013 says UK oil and gas professionals...

...parity between motor spirit and diesel pump prices, presumably via excise duty adjustments, to close the current 25 eurocents/litre gap. Levied on heating oil not transport fuels, a carbon tax...

...by the European Commission for tax rebated fuels replaces the original Euromarker, Solvent Yellow 124, with a marker meant to be more resistant to removal and less environmentally toxic. According...

...(in $m) 86 55 311 359 Profit before tax (in $m) 115 28 257 251 Profit after Tax (in $m) 54 65 168 244 Stanlow margins over the KBC...

...get tough on oil and gas companies by closing the loopholes in the windfall tax, extending the sunset clause in the Energy Profits Levy until the end of the new...