Feedstocks

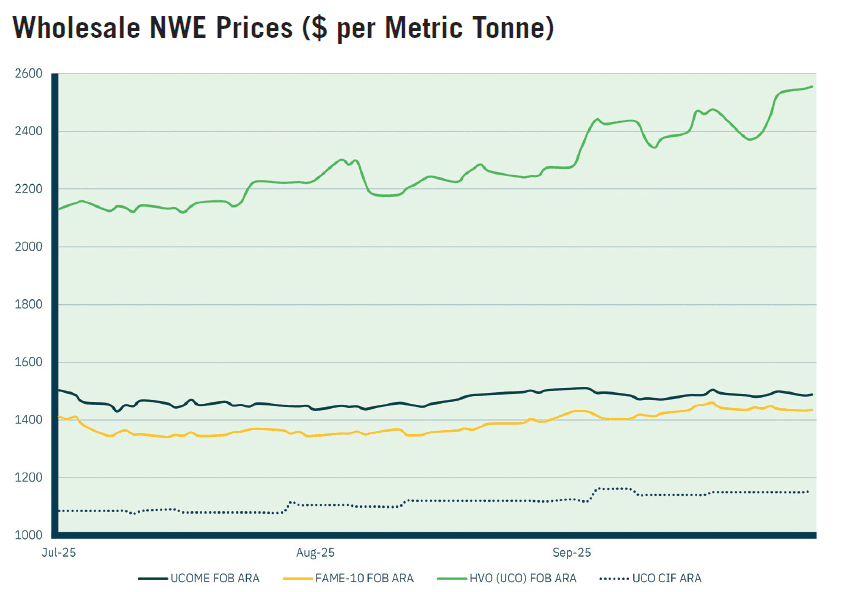

UCO prices remained relatively flat through July, ranging between $1,075-$1,090/mt (69.8-71.8ppl), on subdued trading activity as a result of regulatory uncertainty, as market participants waited to assess the impacts of changes to the US 45Z Clean Fuel Production Tax Credit on supply flows.

Prices then rose into August, as Indonesia increased export levies on bio feedstocks, including UCO, with prices rising to $1,120/mt (73.3ppl). A combination of limited product availability in Europe (a result of reduced Chinese output and ongoing Indonesian export curbs) and high demand for HVO and SAF produced from UCO, saw prices reach a three-year high in September, rising to $1,160/mt (76.3ppl) mid-month.

Prices remained high throughout the remainder of the month, ending the quarter at $1,155/mt (75.7ppl) supported by increased trade.

Biodiesel

Despite an increase in Low Sulphur Gasoil Futures, the primary reference benchmark for biofuel grades, biodiesel prices declined at the start of July, with feedstock prices suppressed due to potential increased UCO availability from China (a result of changes to the 45Z) and production forecasts for rapeseed (the key feedstock in RME, which makes up 90% of the price of FAME-10) being revised upwards as the harvest season began.

Prices then remained flat through much of July, on a lack of trading activity, before trending upwards in August, as feedstock prices began to rise. Biodiesel prices peaked in September, driven by volatility in the underlying gasoil benchmark due to geopolitical tensions, with an escalation of the conflict between Russia and Ukraine, following failed peace talks, disrupting oil supply.

Additionally, exports of rapeseed from Ukraine, which usually peak in Q3, have been dramatically reduced, due to a combination of poor harvest and issues with new export procedures, with August exports down 35% year-on-year.

FAME-10 and UCOME

The UCOME premium to FAME-10 averaged $97.50/mt (6.4ppl) across July and August, peaking at $120/mt (7.8ppl), with UCOME prices supported by a combination of higher summer blending and upcoming regulatory changes in Europe.

UCOME is favoured over FAME-10 as a tool to meet biodiesel targets as it is incentivised through double counting, however poor cold weather performance limits its use in winter. Suppliers therefore optimise UCOME blending in summer, which increases demand.

Upcoming revisions to European biofuels policies, which include the expected scrapping of double counting, have compounded this, as suppliers look to maximise the benefit of this incentive before the changes come into effect.

The differential declined in September, reaching a low of $34.50/mt, as UCOME prices fell relative to FAME-10, with demand shifting to winter grade biodiesel as summer ended. Outright prices for UCOME and FAME-10 ended Q3 at $1,488/mt (97.5ppl) and $1,435/mt (94.1ppl) respectively, a difference of $53/mt (3.5ppl).

Market outlook

Looking ahead to Q4, the key factor likely to affect biodiesel pricing remains regulatory demand, with amendments to national biofuels policies across Europe set to come into legal effect from the first of January 2026.

Although markets have been adjusting to these changes throughout the summer, with high demand forecasts for low-GHG fuels such as HVO leading to multi-year price highs, delays would likely impact pricing.

For example, it is now widely expected that Germany will meet the deadline to transpose its updated biofuel mandate into national law, following continued pressure from industry to finalise the process and provide clarity for investors.

As a result, the phase-out of double counting rules is likely to proceed as planned, which would reshape European biofuels demand by reducing incentives for waste-based biodiesel in early 2026.

On the supply side, refinery shutdowns due to planned maintenance may impact short-term supply, with turnarounds at Neste’s HVO facilities in Rotterdam and Singapore scheduled for Q4 – in an already tight supply market, additional product scarcity will likely lead to inflated prices.

HVO

HVO produced from UCO saw sustained price gains throughout Q3, supported by high demand projections following the expected tightening of double counting rules and increased targets within several EU biofuels mandates, including Germany, France, and the Netherlands, which will limit the ability to meet obligations using first generation biodiesels, thereby increasing demand for HVO.

After opening July at $2,130/mt (121.2ppl), wholesale prices gradually rose across the quarter, peaking at $2,555/mt (148ppl), the highest level since January 2023, on a combination of high demand, increased feedstock prices and expected production shortages as a result of planned refinery maintenance.

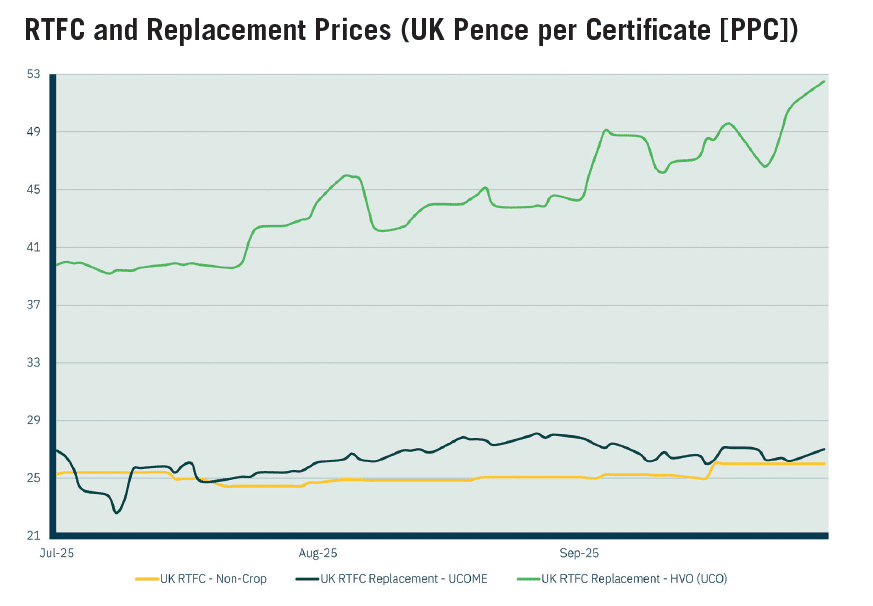

Prices net of RTFCs, i.e. the price available to UK end users, rose from 70.5ppl to reach 96.1ppl by the end of Q3, with the increase in wholesale prices tempered slightly by rising RTFC costs. Waste RTFCs gained around 1ppl over the quarter, increasing from 25ppc to 26ppc (equivalent to 2ppl in benefit to UK HVO buyers as a result of double counting) in line with rising biodiesel markets.

Mineral diesel prices faced downward pressure through much of Q3, largely driven by increased output from OPEC+ and record production in the US. Combined with the increase in HVO prices, this resulted in a significant opening of the HVO-diesel differential across Q3 from 27ppl to 52ppl, the widest level since September 2023 (excluding temporary supply outage in November 2024).

Certificates

Non-crop RTFC prices for the 2025 compliance period, remained relatively flat at around 25ppc through July and August, due to subdued trading activity in biodiesel markets, with UCOME, the primary price-setter for RTFCs, trading in a narrow window through the first half of the quarter.

Although UCOME prices picked up mid-August, RTFC rates lagged behind, likely partly due to a surplus from voluntary HVO demand. Rates did however increase by 1ppc in mid-September, rising to 26ppc following a stronger uptick in UCOME prices, driven by increased feedstock costs and a rise in the underlying gasoil benchmark.

HVO prices may have also contributed slightly to the rise – with demand for HVO in the UK being voluntary, higher prices are likely to impact interest, thereby reducing the amount of RTFCs generated through HVO supply, leading to a tighter certificate market.

News and policy

As part of its ongoing review into the RTFO, the DfT published responses to an initial Call for Evidence in August, outlining potential plans for the future of the scheme. Notably, respondents favoured a general increase to obligations, and some advocated a move to GHG reduction targets, rather than the current volume-based system, bringing the UK RTFO in line with several other European schemes.

A consultation on proposed changes will likely be announced next year, with a view to introduce legislation to come into effect in 2027 at the earliest.

At the beginning of Q3, the UK Trade Remedies Authority issued a notice directing HMRC to register imports of HVO from the USA, as part of an investigation to determine whether US HVO is being subsidised or sold at unfairly low prices, threatening the commercial viability of the UK biofuel industry.

The TRA is expected to release a Statement of Initial Findings in the coming months outlining its preliminary conclusions in order to guide the decision on whether anti-dumping or countervailing duties should be applied to protect domestic biodiesel producers.

info@eslfuels.com 0151 601 5201 www.eslfuels.com

Image credit: ESL Fuels, Dreamstime