Founded in 2019, by partners Albert Farrant and Will Stamp, the firm is relatively small in the private equity space but is a specialist in corporate carve-outs – acquiring businesses that are no longer core to their parent companies.

With over 15 transactions completed since inception, Inspirit works closely with management teams to drive growth, improve operations, and transform acquired businesses into successful standalone entities.

Inspirit Capital’s team comprises experienced professionals dedicated to supporting businesses through the transitional phase. Margaret Major, Fuel Oil News Managing Editor, speaks with two of the team – Investment Director, Paul Youens, and Portfolio Director, Callum Fyfe who have both joined the board at Watson.

With a background in finance, Paul was Inspirit’s first employee, joining four and a half years ago. Callum joined a year ago, after 15 years as a corporate finance advisor supporting management teams of private equity-backed businesses.

Callum will take the operational lead post-acquisition from an Inspirit perspective, working closely with management to support growth under the new ownership.

What determines business value from a private equity perspective?

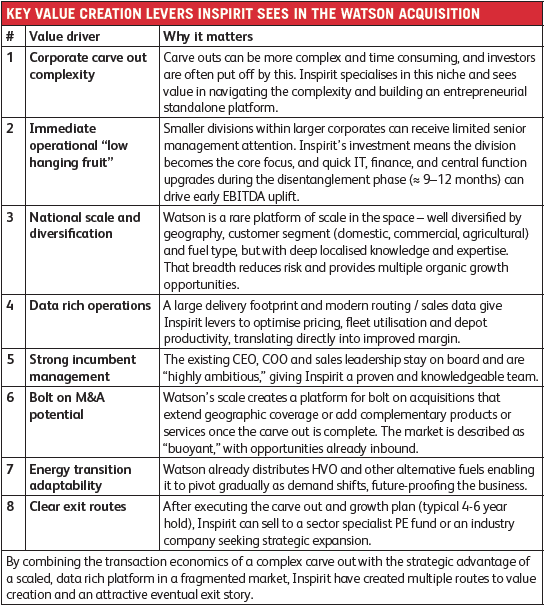

Inspirit Capital’s acquisition of Watson Fuels represents a rare move in the UK’s fuel distribution sector – a carve-out led by a private equity firm rather than a trade buyer. So, what does a PE firm like Inspirit look for in a potential investment?

“We’re fundamentally situation-focused rather than sector-specific,” explains Paul. “We specialise in corporate carve-outs – where a division is sold off by a larger parent company, often because it’s become non-core.”

This structural complexity, while off-putting to some investors, is where Inspirit sees opportunity. “They’re often more complex and time-consuming, but we’re happy to roll up our sleeves,” Paul continues.

“Given this inherent complexity there is often low-hanging fruit in terms of operational improvement – whether that’s strengthening or supplementing leadership, improving systems, or building out standalone infrastructure.”

Watson Fuels ticked several important boxes for Inspirit: a national footprint, a diversified customer base, and a strong market position. “It’s rare to find that scale and heritage brand status,” notes Callum. “It’s a data-rich business, which allows us to make better-informed decisions at both strategic and operational levels.”

Callum also highlights the opportunity for cultural transformation with standalone ownership allowing for much more agile decision-making: “We look at the ability to inject entrepreneurial behaviours at the depot level. That’s what drives growth in a business like this.

“There is often misalignment between a global strategy under previous ownership and what is needed at a UK level. Carve-outs allow for a UK-centric focus, empowering management to make better decisions. This is certainly the case with Watson, which was owned by a Miami-based company with limited UK exposure.”

Why carve-outs are different and why some deals don’t get over the line

For all their potential upside, carve-outs also come with pitfalls. “The main deal-breaker is surprise,” Paul says. “If you’re well into a process and something material comes up that hasn’t been disclosed – say a known financial issue or trading challenge – it erodes trust.”

Transparency and preparation are critical. “It’s not that issues are a problem in themselves,” adds Callum. “It’s how they’re surfaced and managed. We’ve had sellers be completely open about challenges, and that gives us time to plan.”

Buyers also assess how deeply the business is embedded in the parent structure. “In Watson’s case, there were shared IT systems, parts of the finance function – so we knew from the outset that disentangling would be a big part of the first phase, which is where we bring significant expertise to ensure that the separation is executed as smoothly as possible” Paul comments.

BENEFITS OF SELLING TO A PRIVATE EQUITY INVESTOR

- Retained management team autonomy

- Faster decision-making, fewer layers

- Access to growth capital without being absorbed

- Focus on operational improvement, not consolidation

- Potential for personal reinvestment or incentive alignment

Transparency, teamwork and timing: what helps a deal succeed

“A seller who is well-prepared, who understands what’s involved in a carve-out – that helps enormously,” Callum says.

For Watson Fuels, early engagement with World Kinect’s CFO made a difference. “It gave us a chance to explain how we work, why our approach suits complex transactions, and how we’d support both the corporate and the carve-out business,” Paul shares.

Equally important is a mindset shift: “If a management team sees the change as a chance to step up, rather than something being done to them, the whole process becomes more productive,” adds Callum.

Private equity vs industry buyer: what sets them apart

With the Watson deal bringing a new angle to sector acquisition we contrast the PE approach with the more common industry buyer route.

Paul is clear: “One of the biggest differences is that in a PE-backed deal, management typically retains significant autonomy. You’re not being absorbed into another operator’s hierarchy. That can be very appealing to ambitious leadership teams.”

Callum agrees, adding: “Our approach isn’t about asset stripping, it’s about identifying a strong platform – scale, brand, and people – and supporting it to grow. That’s fundamentally different to some of the consolidation-focused strategies you might see from trade buyers.”

Speed is another differentiator. “We can move fast,” Paul says. “Our decision-making lines are short, and that can be valuable in a sale process where timing matters.”

Still, PE isn’t always the right answer. “It depends on the seller’s priorities,” Callum notes. “A strategic buyer might offer a better fit in certain cases – for example, in very small operators where integration into an existing network is key.”

Case insight: Inside the Watson deal

Watson Fuels was first flagged to Inspirit in mid-2024, and after initial conversations, the process formally launched in the autumn. The deal closed six months later.

“We had a good early dialogue with World Kinect’s CFO, which helped,” says Paul. “And Deloitte ran a tight process on the sell side. In general, we have seen acquisition timelines stretch over the last few years due to increased risk sensitivity and greater caution across debt markets, but six months for the Watson Fuels acquisition is reasonable for a complex carve-out.”

Why did Watson stand out?

“Watson is a heritage brand with national scale and strong data – all of which supports strategic decision-making and delivery efficiency. The scale of the business, the strength of the brand, the diversification across fuel types, geography and customers – those were all attractive,” says Callum.

“And crucially, the management team. The existing senior leadership team has deep sector knowledge and is highly ambitious.”

Watson’s shift from Miami-based World Kinect to UK-focused private equity has been positively received. “There’s a real appetite internally for faster decision-making and for being able to own strategic direction,” Callum notes. “Moving away from a corporate into a more dynamic environment is something they’ve embraced with enthusiasm and excitement.”

WHAT HAS CHANGED AND WHAT HASN’T AND HOW IS THE WATSON FUELS TEAM BENEFITING?

- Same management team: Inspirit retained the full senior leadership team.

- More control: Faster, local decision-making tailored to the UK market.

- Clear focus: No longer one of many divisions in a global portfolio.

- Strategic investment: Inspirit is supporting new IT systems and standalone infrastructure.

Looking ahead: Inspirit’s plans for Watson Fuels

“We’re a typical fund with a finite life,” Paul states. “Similar to most PE firms, our hold periods are, typically, 4-6 years. We’ll exit as some point – maybe to another PE firm or to a corporate investor.

The first phase is disentanglement of shared legacy systems, and the company is now in the thick of building out a standalone strategy.

“That’ll take around 9 to 12 months,” Paul suggests. In parallel, we’re working to build value – through operational improvements, resetting growth ambitions, and positioning for an eventual successful exit.”

The acquisition of Watson Fuels is a first for Inspirit in this sector – but, potentially, not the last.

“Since completing the deal, we’ve already been approached by others in the market. There’s clearly a level of activity and opportunity in this space,” Callum notes.

Could that mean further acquisitions?

“Not another standalone platform – Watson is our entry point,” Callum replies. “But we’re open to strategic bolt-ons that support the core business.”

What about industry headwinds like decarbonisation?

“We’re realistic about the energy transition,” Paul says. “But we don’t see an overnight shift. Watson already supplies HVO and other alternatives, and their diversification helps mitigate risk. Over time, we’ll adapt with the market.”

Finally, what advice for a distributor thinking of selling?

“Be transparent,” urges Paul. “And prepare – understand what a carve-out involves, and how your business looks without the parent structure around it.”

“Most importantly, see it as an opportunity,” Callum adds. “For the right team, this kind of transition can be transformational – not just for the business, but for the people inside it.”

So, this isn’t an asset-stripping play?

“We’re here to support growth,” Callum replies. “We’re excited about working with a great brand and management team to build on its strong foundation.”

Image credit: Watson Fuels, Inspirit Capital