Announcing a commitment to return £800m to shareholders alongside further investment in energy sector M&A, the group is progressing plans to pivot to an energy-focussed future. The annual results highlight significant strategic progress as well as robust performance, particularly in the group’s energy division.

Healthcare divestment

DCC plc has confirmed the sale of its healthcare division, delivering on its stated intention (November 2024) to simplify the group and focus on energy.

The transaction, expected to complete Q3 2025, will deliver £1.05 bn. With £800m slated for shareholder returns, the Healthcare exit will also fund the energy pivot, providing capital for energy‑transition merger and acquisition activity.

Chief Executive Donal Murphy commented: ‘Our sale of DCC Healthcare enables a material return of capital to shareholders. We will focus our efforts on Energy, our largest and highest-returning business. We are energised about the future.’

DCC’s focus on the Energy sector aligns with its “Cleaner Energy in Your Power” strategy.

Headline financial performance

Group numbers hold up despite softer energy commodity prices. Annual revenue of £18.0 bn is down 4.5 % yoy, but adjusted operating profit has grown 3 % to £703.6 m; enabling DCC to deliver its 31st consecutive dividend rise (+5 % to 206.4p).

Energy division powers growth

- Operating Profit of £535.5 m represents a 6.5% increase yoy, driving the uplift in group operating profits.

- Volume is steady at 15.2 bn litres sold.

The Solutions business (energy products and energy services) delivered strong growth with operating profit increased by 7.4% to £411.8 million. The growth was mostly driven by energy services thanks to acquisitions completed in the current and prior year, with organic growth of just 0.7%. Solutions volumes increased by 2.3%, despite the headwind of mild weather conditions. This was offset by a decline in Mobility volumes of 5.1% leaving overall volumes flat.

Double profit. Half Carbon. The DCC clean energy strategy

In 2022 DCC plc stated its ambition to double profits and halve its carbon by 2030, with growth in biofuels forming an important part of this strategy: “Greening our existing fuels business plays an important part in our plan to both double our profits and halve our carbon between 2022 and 2030.”

What’s working

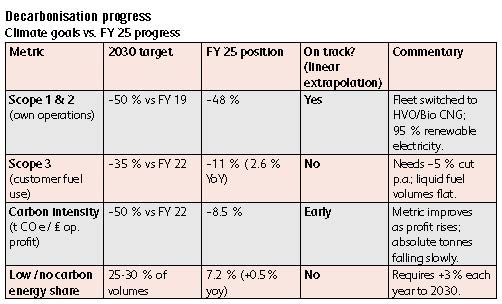

Operational footprint trimmed fast – a 48% reduction cf 2019 puts DCC almost at the 2030 Scope 1 & 2 goal of 50% reduction five years early.

Rapid wins came from switching grid electricity to renewables and rolling out HVO/Bio-CNG in the UK and Irish truck fleets. Little “low-hanging fruit” remains – future gains will be harder and costlier.

Capital redeployed into transition assets – £106 m of bolt‑on deals in solar, storage and energy management.

Where acceleration is needed

Customer emissions – 90 % of the footprint sits with downstream fuel use. Currently standing at 11% reduction against a target of 35%, the rate of reduction needs to double from the current 2.6% to stay on target. Unless renewable content of liquid-fuel rises far more rapidly – or volumes start to contract – DCC’s interim milestone could be at risk.

Low-carbon fuels share – with a target of 25-30% low carbon share by 2030 and the current figure at only 7.2% it needs to rise by around 3% each year to achieve target level.

Divesting Healthcare, ploughing proceeds into energy transition M&A, and tying profit growth to halving customer emissions sends the right message. However, organic and inorganic investment will have to accelerate materially to achieve the 2030 goal.

Summary

DCC’s strategic focus on its Energy division, coupled with disciplined capital allocation and commitment to decarbonisation, means the company is well-positioned for continued growth and shareholder value creation.

The business has largely decarbonised what it controls but meeting the customer-emission and low-carbon fuels share goals depends, in part, on the same market reforms the wider liquid fuel industry is lobbying for: to drive an accelerated roll‑out of HVO and other low‑carbon liquid fuels.

Delivering the 2030 targets will therefore require both continued investment by DCC in growing its renewable energy division, and a regulatory framework that both enables and rewards the displacement of fossil diesel and heating oil at scale.

Image credit: DCC Plc