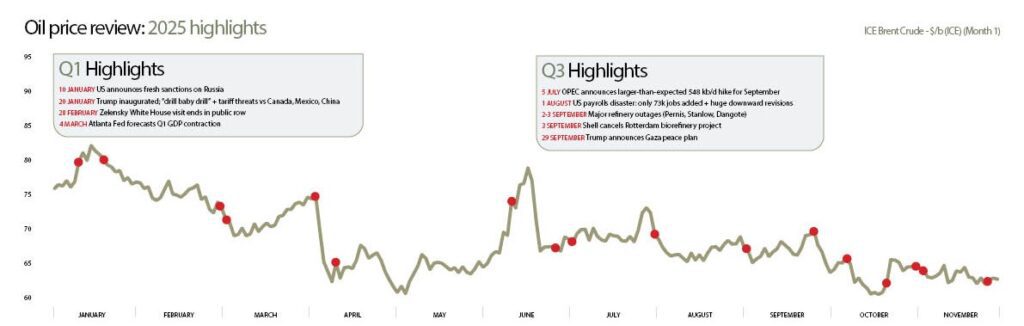

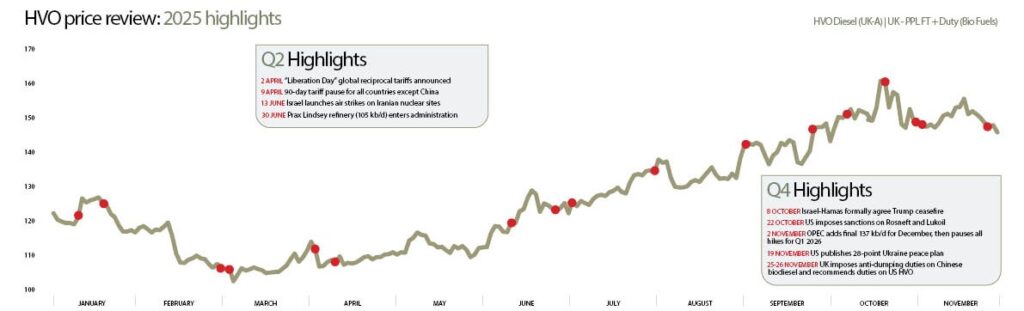

The following article presents graphs that shows how fuel prices have varied through 2025. The data presents HVO diesel alongside Brent crude data, with data supplied by The Oil Market Journal. the markers and text boxes highlight some of the key events throughout the year that have impacted on the pricing.

We hope that it provides an interesting and insightful look back over a year which, once again, has presented those operating in the liquid fuel sector, with a broad variety of challenges.

Oil 2025

Q1 2025 – Inauguration Euphoria to Tariff Terror

2025 began with champagne corks popping, as markets priced in President Trump’s promised pro-business agenda. Within weeks the mood turned to panic. Tariff chaos, a dramatic US pivot toward Russia, ARA stock builds and recession fears hammered oil, the dollar and equities. After a brief post-inauguration spike, Q1 delivered savage losses as the post-WW2 global order looked shakier than it had in eighty years.

January

Biden’s parting gift was fresh sanctions on Russia; the IEA promptly warned of a tighter crude balance. A brutal US cold snap and icy weather across Northwest Europe gave demand a helpful shove. Days before Trump’s inauguration, Israel and Hamas declared a ceasefire, widely seen as a response to the president-elect’s blunt threats. On 20th January Trump repeated “drill baby, drill” in his inaugural speech and promised an American production boom. Initial tariff threats against Canada and Mexico were brushed off. From Davos, Trump demanded OPEC open the taps to cut inflation and free central banks to slash rates.

February

The month became a nerve-wracking “will-they-won’t-they” on tariffs. Promised levies were suspended, then new threats issued almost daily, none actually implemented – thanks to frantic last-minute diplomacy. US consumer confidence cratered in its sharpest drop since 2021. ARA gasoline stocks hit an all-time high, underlining Europe’s refining woes as Nigeria’s giant Dangote refinery steamed toward full output. A first jet kero tanker sneaked through the Red Sea, but the relief was fleeting.

Most disturbing was Washington’s abrupt tilt toward Moscow. Trump spoke to Putin on 12th February; VP Vance tore into European allies at Munich; US and Russian officials then discussed Ukraine peace terms without Kyiv at the table. Zelensky’s White House visit on 28th February to sign a minerals deal ended in a shouting match over his wartime attire and alleged ingratitude. Markets read the signals loud and clear: a possible “peace at any cost” deal could soon flood the world with cheap Russian barrels.

March

Bearish momentum rolled on. The first hard tariff (25% on steel and aluminium from all nations) finally landed. Intelligence sharing with Ukraine was paused. Europe responded with plans to smash Germany’s debt brake and a proposed €800 bn defence splurge. In the US, the Atlanta Fed model flashed Q1 GDP contraction; Trump refused to rule out recession on Fox News; small-business optimism evaporated and the S&P 500 entered official correction territory. UK pump prices posted their first weekly fall since September.

Q2 2025 – Liberation Day and the Great OPEC Flood

Q2 was defined by Trump’s “Liberation Day” tariffs and three monster OPEC production hikes. Lower demand + surging supply = lower prices. Brent crashed below $60/b, a four-year low, before geopolitical flare-ups dragged it most of the way back by late June.

April

2nd April 2025 will go down as the day the post-war trade order died. “Reciprocal” tariffs were slapped on every country on Earth, even the penguin colony on Heard and McDonald Islands. The next day OPEC announced a 411 kb/d hike for May. Brent lost 10% in 48 hours.

A week later Trump unveiled 104% tariffs on China (promptly met with 84% retaliation) and crude duly sank below $60/b.

Amid carnage in stocks, the dollar and bond markets, Trump executed a screeching U-turn: a 90-day pause on the global tariff and a reduced 10% baseline, but the China embargo escalated to 145%/115%. IEA and OPEC slashed demand forecasts. Jerome Powell warned tariffs would hurt growth; Trump threatened to fire him (he later backed off). Q1 GDP was confirmed negative, the first contraction since 2021.

May

Another 411 kb/d OPEC hike for June, then another 411 kb/d for July. A Houthi missile hit Ben-Gurion airport on 4th May; joint US-Israeli strikes followed, yet Brent still closed at $60.23/b, the YTD low.

Relief came mid-month: a UK-US trade deal (small but symbolic) and a surprise 90-day US-China tariff truce (30%/10%). Physical markets suddenly tightened. ARA product stocks fell below the five-year average for the first time in 2025 and US distillate inventories hit the lowest since 1990. Prices tried to rally but were repeatedly capped by the next looming OPEC hike.

June

Geopolitics reclaimed centre stage. Ukraine destroyed at least 40 Russian warplanes; the Caribou Lake wildfire threatened Canadian oil-sands output; then, on 13th June, Israel hit Iranian nuclear sites. Tit-for-tat escalation sent Gasoil futures exploding through $700/t. The US eventually joined strikes on 21st June. Late on 30th June came the shock news that the 105 kb/d Prax Lindsey refinery in Lincolnshire had entered administration.

Q3 2025 – Refinery Shock, OPEC Avalanche, Ukrainian Drones

Lindsey’s collapse, three more enormous OPEC hikes and relentless Ukrainian drone attacks on Russian refineries produced violent two-way swings. US distillate began the quarter at 20-year lows and ended it almost back to seasonal norms.

July

Lindsey administration news detonated distillate prices; front-month ICE Gasoil jumped >$100/t by 10th July. US distillate stocks hit the lowest July level since 2005 and ARA gasoil was 13% below average. Counterbalancing bears arrived quickly: French ATC strikes crushed jet premia, Exxon brought a big new Fawley hydrotreater on line and BP reversed its Gelsenkirchen CDU closure plan. OPEC stunned markets with a 548 kb/d hike for September, the clearest signal yet that Riyadh was willing to fight for market share.

August

Dreadful US payrolls (just 73k added, huge prior-period revisions) prompted Trump to sack the BLS chair and sparked Fed Governor resignations. Trump and Putin met in Alaska, nothing achieved. Ukrainian drones, however, were brutally effective, knocking 14 Russian refineries offline during the month alone. Powell’s Jackson Hole speech confirmed rate cuts were coming.

September

Shell took the giant 404 kb/d Pernis refinery down for maintenance, Stanlow suffered an extended outage and Dangote reported months-long problems, European refining took a triple hit. More weak payrolls were almost ignored when Israel struck Hamas leaders in Qatar and Poland shot down Russian drones. By mid-month global stocks had recovered sharply; both the DoE and IEA forecast massive oversupply into 2026. Trump’s surprise Gaza peace plan on 29th September knocked the legs out from under the risk premium.

Q4 2025 – Middle East Peace, Russian Sanctions, OPEC Pauses

The Israel-Hamas war ended; joy was short-lived as all eyes swung back to Ukraine and Russian supply.

October

A 43-day US government shutdown began, data vacuum made the Fed cautious. OPEC added a modest 137 kb/d for November. Israel-Hamas ceasefire implementation sent prices reeling lower. Ukraine intensified refinery drone strikes; Trump’s Hungary summit with Putin was cancelled in disgust. Late-month US sanctions on Rosneft and Lukoil (effective 21st November) sparked a sharp bounce.

November

Sanctions chaos and the surprise announcement that OPEC would freeze quotas through Q1 2026 propelled Gasoil briefly above $800/t. Nigeria’s aborted gasoline import duty triggered a frantic import rush before being scrapped. On 19th November the US published a 28-point Ukraine peace plan, widely seen as Moscow-friendly in its first draft. Prices collapsed into month-end as traders positioned for the eventual return of Russian barrels..

2026 Preview

Fundamentals scream oversupply: record US production, 2.74 mb/d of extra OPEC+ supply added in 2025 alone and global stocks above the 10-year average for the first time since 2017 (outside the pandemic). The Fed is cutting rates into a fragile labour market, not a booming one. If sustainable peace breaks out in Ukraine, Brent has further to fall, $55/b is already in many bank forecasts. But in a world led by tweet, drone and tariff; data-driven insight remains our only reliable compass.

One thing is certain: 2025 was the year volatility came home to roost. Fasten your seatbelts for 2026.

Biofuels 2025Biofuels were at the mercy of the same forces as the wider oil market, only with sharper policy and supply shocks layered on top.

Q1

Biofuels began 2025 dragged down by falling ICE Gasoil. Prices were briefly supported after 9th January when the EU imposed anti-dumping duties on Chinese biodiesel. Abundant HVO supply sent premiums tumbling; by mid-February HVO less two certificates traded at a rare discount to B7 diesel for several weeks. UCOME and RME premiums widened sharply as flat price fell. Investment appetite cooled further when Neste paused its Rotterdam biorefinery expansion and BP cut biofuel capex, both citing policy uncertainty out of Washington.

Q2

Q2 felt the full force of global tariff chaos before the worst levies were paused. The UK-US trade deal announced on 8th May removed barriers to US ethanol exports, immediately threatening domestic producers. Vivergo and Ensus warned of closure; Greenergy temporarily idled its Immingham biodiesel plant. Rising certificate values later in the quarter revived physical blending demand, pushing HVO premiums to six-month highs. A two-week suspension of Preem’s ISCC certification at Gothenburg in June tightened the market further; FAME-0 reached its highest level in two years.

Q3

Q4 brought another violent swing. HVO posted genuine three-year highs in October as traders priced aggressive German legislation, only for repeated cabinet postponements to knock premiums lower again. Trafigura confirmed permanent closure of its long-idle Immingham plant. The UK finally imposed anti-dumping duties on Chinese biodiesel and the TRA recommended similar measures against US-origin HVO.

2026 Outlook

Conventional biodiesel and bioethanol face continuing import pressure and blend-wall limits. HVO remains highly sensitive to the pace of RED III rollout, certificate pricing and any fresh fraud clampdowns. With UK production capacity shrinking fast, the market will stay tight and volatile.

Fuel price review: 2025 highlights

January

9 EU imposes anti-dumping duties on Chinese biodiesel

10 US announces fresh sanctions on Russia

15 Israel-Hamas ceasefire announced

20 Trump inaugurated; “drill baby drill” + tariff threats vs Canada, Mexico, China

23 Trump demands OPEC cut prices to help central banks ease interest rates

February

12 Trump-Putin phone call

12 Neste pauses Rotterdam biorefinery investment

28 Zelensky White House visit ends in public row

March

3 US pauses military aid and intelligence sharing with Ukraine

4 Atlanta Fed forecasts Q1 GDP contraction

5 EU proposes €800 bn defence package

April

2 “Liberation Day” global reciprocal tariffs announced

3 OPEC hikes May quotas by 411 kb/d

8–11 US-China tariff war escalates (104% → 145% US, 84% → 125% China)

9 90-day tariff pause for all countries except China

30 US Q1 GDP confirmed –0.3 %

May

3 OPEC agrees another 411 kb/d for June; Brent closes below $60/b

8 UK-US trade deal opens door to cheap US ethanol

12 US-China 90-day tariff truce

31 OPEC agrees third 411 kb/d hike for July

June

1 Ukraine deep drone strikes destroy 40+ Russian warplanes

13 Israel launches air strikes on Iranian nuclear sites

21 US joins strikes on Iranian nuclear sites

30 Prax Lindsey refinery (105 kb/d) enters administration

July

5 OPEC announces larger-than-expected 548 kb/d hike for September

August

1 US payrolls disaster: only 73k jobs added + huge downward revisions

22 Powell signals rate cuts at Jackson Hole

September

2-3 Major refinery outages (Pernis, Stanlow, Dangote)

3 Shell cancels Rotterdam biorefinery project

17 Fed cuts rates

29 Sep Trump announces Gaza peace plan

October

1 43-day US government shutdown begins

8 Israel-Hamas formally agree Trump ceasefire

22 US imposes sanctions on Rosneft and Lukoil

November

2 OPEC adds final 137 kb/d for December, then pauses all hikes for Q1 2026

19 US publishes 28-point Ukraine peace plan

25- 26 UK imposes anti-dumping duties on Chinese biodiesel and

recommends duties on US HVO

All data and analysis provided by The Oil Market Journal.

To find out more and request a free trial:

+44 (0) 28 6632 9999 info@the-omj.com www.the-omj.com

Oil price review: 2025 highlights

HVO price review: 2025 highlights

Image credits: Oil Market Journal, stock image