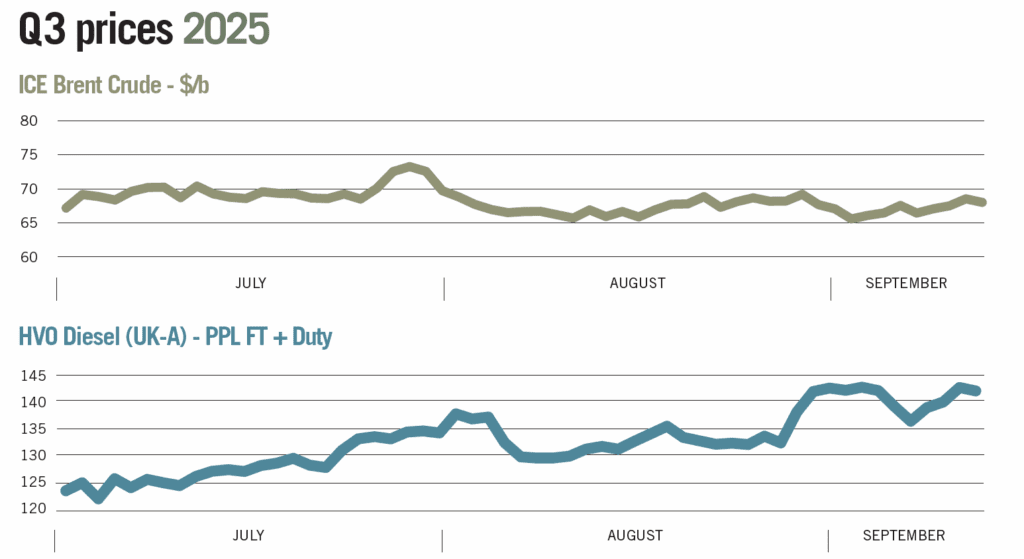

A quarterly review of the movements of, and impacts on, brent crude and HVO diesel prices.

With data supplied by the Oil Market Journal, we highlight some of the key events that have impacted pricing over the third quarter of 2025.

Q3 2025

Quarter 3 2025 was dominated by increasing geopolitical tensions across the world alongside major unwinding of OPEC production cuts. Ukrainian drone strikes became more brazen and continued to disrupt Russian oil flows, while three further OPEC supply hikes contributed to the prospect of oversupply and high stocks. Q3 also saw a recovery in stock levels – beginning with US distillate stocks at their lowest level in over 20 years, and ending with stocks just 0.5mb below levels seen this time last year.

July

July began with spiralling distillate prices after news on 30th June, that the 105,700bpd Prax Lindsey refinery in Lincolnshire was entering administration. The news came as a surprise to UK oil markets and risked domestic supply.

By the contract expiry on 10th July, the ICE Gas Oil front month was trading over $100/t. higher than the month two swap. Prices were also supported by tight fundamentals, with US distillate stocks hitting the lowest level since April 2005, on the 4th July. Similarly in Europe, ARA Gasoil stocks were 13% below the 5-year average for the month of July.

However, there were a number of bearish factors for prices in July, despite the predominantly supportive news early in the month. On 3rd July, French air traffic control went on a 2-day strike which sent Jet Kero differentials to ICE Gasoil tumbling at the start of the peak summer travel period.

On 5th July, OPEC announced a major 548,000bpd hike to production curbs which was larger than expected, and sent signals of a new policy with the cartel aiming to restore market share after years of targeting higher oil prices. ExxonMobil announced plans to start up a new 38,000 bpd hydrotreater at the UK Fawley refinery which will greatly boost diesel supply, and BP reversed its decision to close the 80-90,000 bpd crude distillation unit at the Gelgenkirchen refinery in Germany.

Therefore, the impact on pricing on the futures market from a loss of supply from the Prax refinery, was relatively short-lived.

Prices found support once again, on news that President Trump agreed to send Patriot missiles to Ukraine. However, his promise of harsh economic sanctions on Russia were not followed through, and traders grew sceptical of their chances.

Trump’s attacks on Federal Reserve chairman Jerome Powell continued to grow, and increasingly spooked markets with rumours of an imminent sacking. Petrol prices weakened amid underwhelming demand in the summer driving season, and E10 barges traded below the month 2 Eurobob swap by the end of July.

August

August began with the monthly non-farm payrolls for July, which showed that the US economy added 73,000 jobs in July – much lower than estimates of 111,000. More significantly, May and June’s figures were revised down by 258,000 from initial estimates, with only 14,000 jobs added in June.

Trump responded by firing the chair of the BLS, which is responsible for producing the data, however, the naming of a close ally as a replacement led to questions over the independence of US economic data.

Fed Governor Kugler also resigned from the FOMC, opening up a space for Trump to nominate Stephen Miran as a Fed Governor. It was confirmed that Trump had not yet made up his mind on the next chair of the Fed and that Miran would only serve out Kugler’s term which expires in April 2026.

OPEC announced a further 548,000bpd production hike for September, which added to negative sentiments in oil markets.

Trump met Putin for a much anticipated conference in Alaska, to discuss a peace deal to end the war in Ukraine. However, the meeting yielded few results. As battleground stalemate continued in Ukraine, Ukraine turned increasingly to cheap, but highly effective, drone strikes against Russian refineries.

All-in-all, Ukraine put no less than 14 Russian refineries offline in August alone, in a notable tightening of oil supply chains.

On 22nd August, Fed Chair Powell highlighted increasing concern over labour markets at the annual Jackson Hole conference. Powell suggested that it may be appropriate to adjust monetary policy. His words confirmed market pricing and lower interest rates are traditionally seen as a stimulus for higher oil prices.

September (as of 17th)

September began with two major reports of European refinery disruption. Shell closed its 404,000bpd Pernis refinery in Rotterdam for maintenance, while an unexpected outage occurred at the Essar Oil Stanlow refinery, impacting UK petrol supplies. Further to this, the new Dangote refinery also reported an outage that is expected to last up to several months.

Since coming online, the Dangote refinery has been a mass producer of refined products, and has contributed to the perils facing European refinery sustainability.

Non-farm payrolls for July were also disappointing, with 22,000 jobs added rather than expectations of 75,000. Annual revisions to payroll data showed 911,000 fewer jobs were added than initially reported in the 12 months to March 2025.

However, the weak US economic news was somewhat lost by news, also on 9th September, that Israel attacked Hamas officials in Qatar. European geopolitical risks also increased, with Poland shooting down Russian aircraft the following day.

Prices began to weaken in mid-September, as global stock levels recovered over the summer. ARA Gasoil stocks were above the 5-year average by 4th September, and US distillate stocks were just 0.5mb below last year on 17th September.

The US Department of Energy’s Short Term Energy Outlook and the International Energy Authority both forecast large oversupply in global oil markets for 2025 and 2026. However, the downside risk for prices continues to be limited by ongoing Ukrainian attacks on Russian refineries.

Biofuels

Biofuel prices rose sharply throughout the summer, due to a number of factors primarily related to European legislation. In late June, Germany published its draft RED III bill which proposes GHG quotas be doubled from 2030, to meet new EU targets as set out in RED III.

Another factor is Germany’s push to abolish the good-faith protection rule for buyers of illegitimate GHG certificates in response to growing concerns about fraud in the biofuels market, particularly with mis-declared feedstocks like used cooking oil and POME. The rule, often referred to as the “confidence principle”, currently protects buyers who purchase fraudulent certificates in good faith, allowing these certificates to remain valid unless intentional fraud is proven.

This has enabled fraudulent volumes, such as the estimated 1.8 million tons of mis-declared POME that entered the EU in 2023, to be counted toward Germany’s GHG reduction targets, undermining climate goals and depressing prices for legitimate producers. Higher GHG costs have led to increased demand for HVO as physical blending become more attractive. The Dutch proposals to meet RED III requirements included abolishing double counting, thus increasing physical demand further.

In the Netherlands, HBE-G certificates have also risen compounding HVO demand across the continent. Ukraine also imposed a 10% export duty on rapeseed and soybeans from September, which reduces the wider feedstock supply in Europe – given Ukraine’s status as the ‘breadbasket of Europe’. The duty was proposed in July, and first came into effect in September.

Preem’s 300,000 tonne per year Gothenburg biorefinery lost its ISCC certification for over two weeks, which significantly tightened European supply chains at a time when demand was rising. Shell announced this week the cancellation of plans to resume construction of its biorefinery in Rotterdam, which reduces future supply volumes. HVO prices are currently at the highest level since the spike last November, when a fire broke out at the Neste biorefinery in Rotterdam.

The UK biofuel industry has come under increasing pressure as a result of the UK-US trade deal which removed barriers for US ethanol exports to the UK. On 18th August Vivergo announced the closure of its ethanol plant, and Greenergy temporarily closed its Immingham biofuel plant, citing unsustainable market conditions. In a supportive development, the UK Trade Remedies Authority recommended anti-dumping duties of up to 54.64% on Chinese biodiesel. The move comes after the EU announced similar measures last year.

Q3 2025 Key dates

JULY

1 ICE Gasoil backwardation spirals on Prax announcement

3 French 2 day air strike

4 US distillate stocks at lowest level since April 2005

5 OPEC announces 548,000bpd increase for August

10 ARA gasoil stocks at 18-month low

13 Trump agrees to send patriot missiles to Ukraine

14 Trump gives 50-day deadline for extreme sanctions on Russia

16 Ukraine votes to introduce 10% export duty on rapeseed and soybean

AUGUST

1 US non-farm payrolls 73k v expectations of 110k, May and June revised down 258k, June now just 14k

3 OPEC announces 548,000bpd increase for September

15 Trump-Putin Alaska conference

18 Vivergo ethanol plant to close

18 Ukraine attacks the Druzha oil pipeline

20 Ukraine strikes Rosneft refinery

22 UK TRA recommends anti-dumping duties of up to 54.64% on Chinese biodiesel

22 Powell signals rate cuts at Jackson Hole

26 Greenergy announces temporary closure of Immingham biofuel plant

SEPTEMBER

2 Shell closes 404,000bpd Pernis refinery in Rotterdam for maintenance

2 Outage at Essar Stanlow refinery petrol unit

2 Dangote outage at petrol unit

3 Shell cancels Rotterdam biorefinery construction resumption

5 US non-farm payrolls 22k v exp 75k

7 OPEC agree 137,000 bpd increase for October

9 Israel strikes Hamas leaders in Qatar

9 US non-farm payrolls revised down 911k year to March 25, largest revision on record

10 Poland shoots down Russian drones, invokes NATO article 4

12 Russia’s Primorsk refinery attacked

14 Ukraine attacks Kirishi refinery, one of Russia’s largest

16 Ukraine strikes Rosneft refinery in Russia

All data and analysis provided by The Oil Market Journal. To find out more and request a free trial: +44 (0)28 6632 9999

info@the-omj.com

www.the-omj.com

Image credit: The Oil Market Journal, iStock