Indonesia, one of the key exporters of UCO to Europe, halted exports following reports that showed export levels had surpassed production capacity, leading to concerns that exported product may contain mislabelled crude palm oil. January customs data showed a 36% drop in Indonesian UCO exports versus December.

EU anti-dumping tariffs on Chinese UCO were published in the Official Journal of the European Union, listing tariffs of between 10% and 36.4%, expected to last five years, while the US similarly introduced an initial 10% blanket tariff on all Chinese exports.

Biodiesel

Biodiesel markets also trended upwards during Q1, supported by demand following an increase in European biofuel obligations under the Renewable Energy Directive (RED) for 2025. The third iteration of RED (RED III), which raises the target share of renewable energy used in transport sectors to 29% (vs 14% in RED II), is set to be enforced from 21st May 2025.

A general increase in obligations has been exacerbated by decisions from the German and Dutch governments to amend compliance rollover under their national biofuels policies in response to a collapse in certificate pricing following a biodiesel surplus in recent years, due to oversupply of Chinese feedstock.

The Netherlands has reduced its permitted level of rollover from 25% to 10%, whilst in Germany the rollover has been suspended entirely for two years, effectively resetting compliance levels and creating a fresh blending requirement which has driven biodiesel demand.

FAME-10 and UCOME

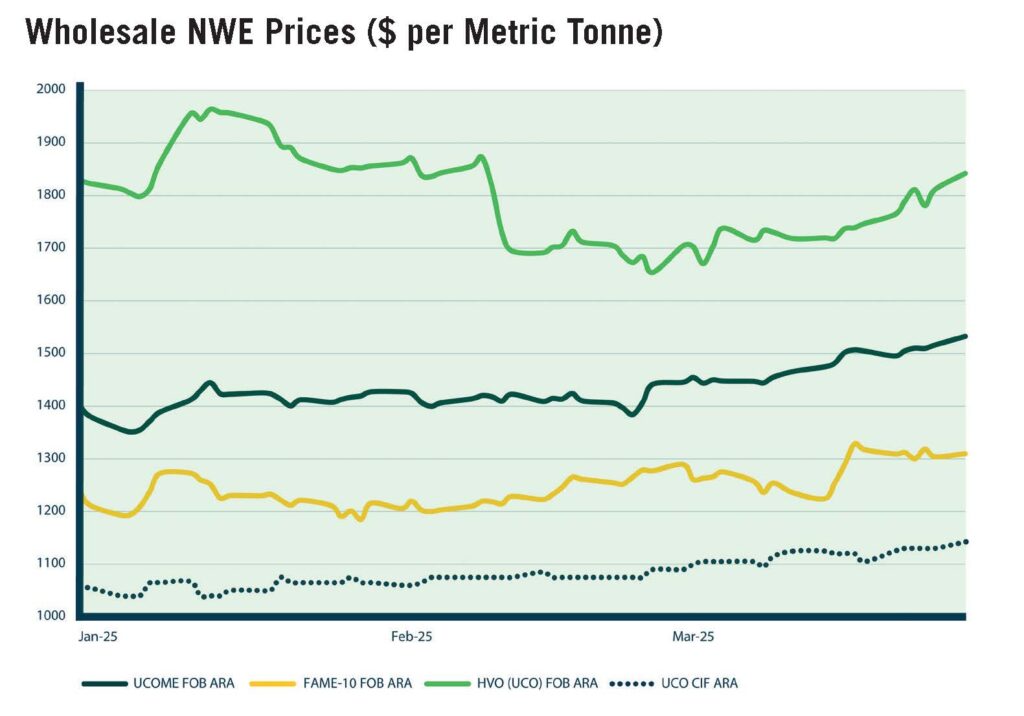

FAME-10 prices, whilst not quite reaching levels seen in November of last year which spiked due to a ‘perfect storm’ of supply outages and demand spikes, saw a steep incline throughout Q1, reaching a high of $1,330/mt (90 ppl) on 20th March after climbing more than $100/mt (7 ppl) w/c 17th March alone, due to an increase in feedstock prices (notably rapeseed, which makes up c. 90% of the content of FAME-10) and a slow-down in production as a result of tight margins.

The UCOME market followed a similar trajectory, however the differential between UCOME and FAME-10 widened towards the end of the quarter, as blenders look to move towards summer specification biodiesel, enabling them to blend a higher content of UCOME (preferred due to double-counting under RED), which is limited in winter due to the poorer cold weather performance of UCOME in comparison to FAME-10. UCOME closed Q1 at $1530/mt (105 ppl), up from a January low of $1350/mt (95 ppl).

Market Outlook

Looking ahead, the key factor expected to affect biodiesel prices will be demand. As suppliers will look to take advantage of warmer weather to increase UCOME blending and meet rising compliance levels, there will also be increased competition for UCO feedstock from other sectors, with higher 2025 targets in aviation (ReFuel EU) and maritime (FuelEU Maritime).

However, tariffs imposed by the US, particularly on imports of UCO from China, could offset this expected demand increase. Despite the EU enforcing its own measures on Chinese UCO, further US tariffs would see product flow back to Europe, increasing supply and easing prices.

Exchange rates will also play a part, as oil and refined products are traded globally in USD. GBP gained 6 cents on USD during Q1, reducing the cost of biodiesel supplied to the UK. The performance of USD as the world reacts to a shake-up in global trade will be another price factor, determining the buying power of UK biodiesel suppliers.

HVO

At the start of Q1, the majority of HVO supply in the UK originated from the USA. However, policy uncertainty following the US election, particularly regarding the future of the Biodiesel Tax Credit (BTC), along with proposed tariff increases on key feedstocks, has reduced the pricing arbitrage between the US and Europe.

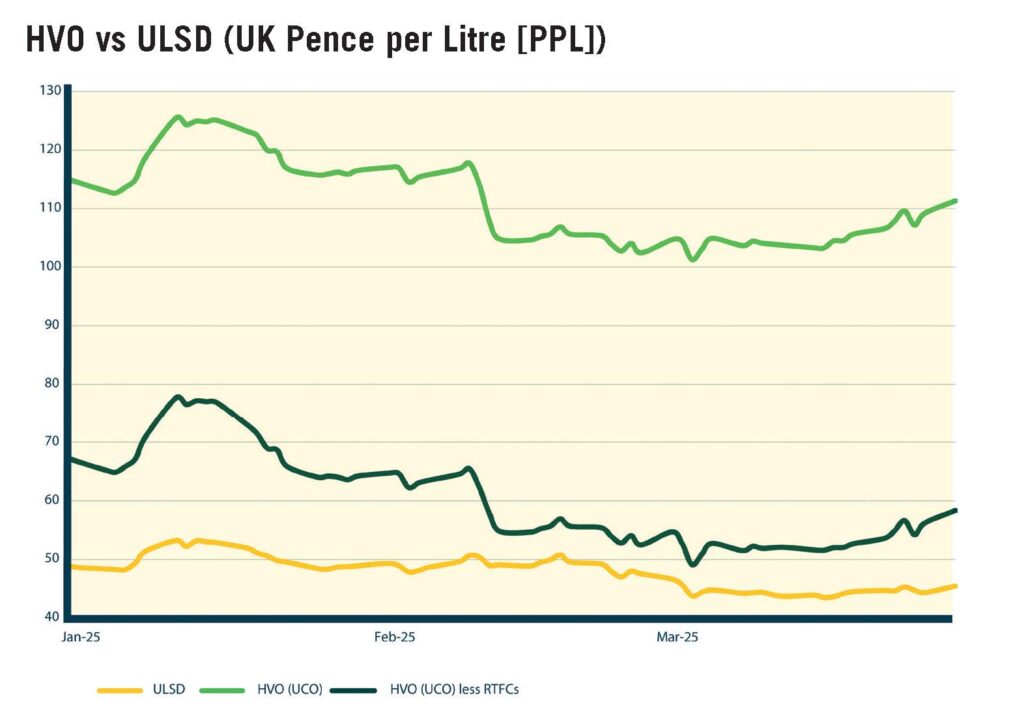

NWE prices of HVO produced from UCO, the most common grade of HVO used in the UK, rose sharply mid-January to reach a quarter high of $1965/mt (125 ppl), before falling by more than $310/mt (23 ppl) over the following six-week period to a Q1 low of $1655 mt (102 ppl). By the end of Q1, HVO (UCO) had reversed some of its losses to trade at $1840/mt (111 ppl), however, demand sentiment remained weak.

UK market HVO prices are affected by the value of Renewable Transport Fuel Certificates (RTFCs) – as HVO from UCO qualifies for double-counting under RED, two RTFCs are generated for every litre of HVO supplied to the UK, the value of which is netted off the cost of HVO.

Accounting for RTFC benefit, wholesale UK HVO prices fell from a mid-January high of 78 ppl (excl. duty and supply costs) to a six-month low of 49 ppl by the end of February, as higher RTFC prices coincided with the fall in wholesale costs.

Prices recovered as the wholesale market climbed $140/mt (7 ppl) in March, however this was tempered by two-year high RTFC prices, with UK HVO prices at 58ppl by the end of Q1.

Certificates

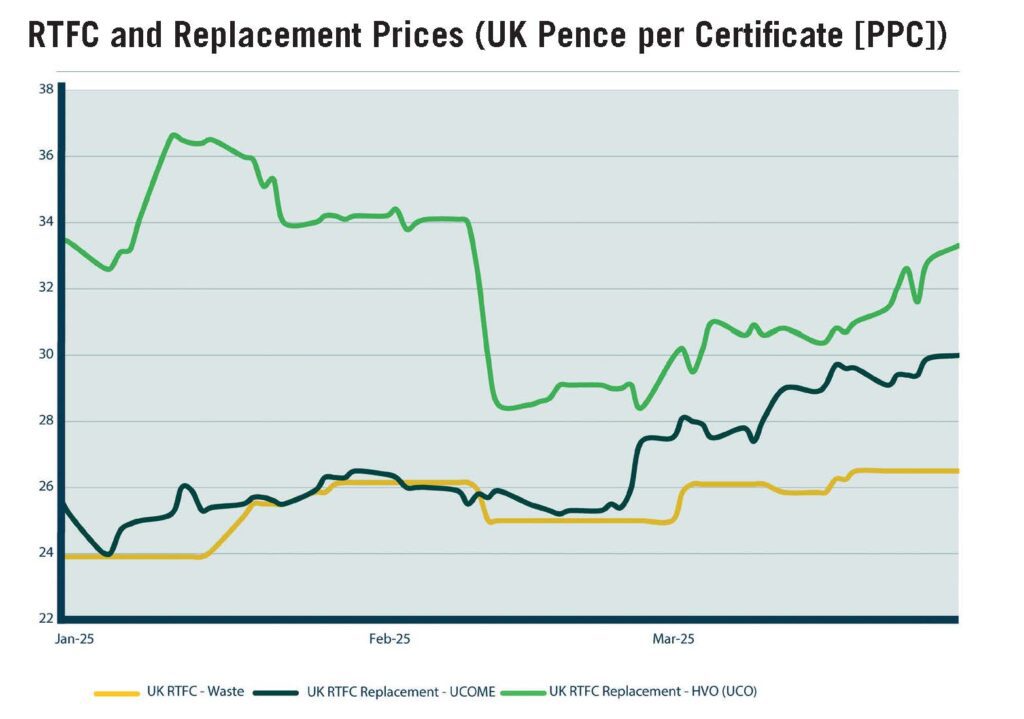

Waste-based RTFCs for the 2025 compliance period started Q1 at 23.90 ppc before rising to 26.30 ppc by the start of February, marking the highest price of RTFCs since mid-March 2023.

Waste RTFC prices reflect the cost of meeting the Renewable Transport Fuel Obligation (RTFO) through blending a variety of biofuels produced from waste feedstock, including UCOME and HVO – the rally in UCOME prices following the Indonesian ban on UCO exports drove this early increase due to resultant higher blending costs.

Lower HVO prices caused RTFCs to drop by around 1.00 ppc in February, with the US renewable diesel market (a key source of exports to the UK) reportedly significantly oversupplied, before prices recovered back to multi-year highs of 26.50 ppc by the end of Q1 as increases on bio outstripped diesel gains.

News and Policy

The EU will vote on whether to suspend automatic acceptance of International Sustainability and Carbon Certification (ISCC) Proof of Sustainability (PoS) certificates for a period of two and a half years. This comes in response to complaints that the organisation has not done enough to address fraudulent activity within supply chains.

Under the proposal, EU member states would be allowed to decide individually whether to accept these certificates, bringing the EU’s approach closer to the UK’s (as per latest RTFO guidance from the Department for Transport).

Without assurance that sustainability scheme certificates will be accepted by government authorities, significant risk is introduced for suppliers of biofuels, as it is often not feasible to audit supply chains directly due to factors such as commercial sensitivities, limited resources, and time constraints.

The UK’s Trade Remedies Authority (TRA) has launched an investigation into US HVO supplied to the UK, following concerns that export prices are below market value, potentially undermining the domestic biodiesel market. EU anti-dumping levies on US product were lifted in the UK in 2022 following Brexit, which led to a significant increase in US imports. The investigation is another factor in the UK market shifting back to European HVO.

info@eslfuels.com 0151 601 5201 www.eslfuels.com

The ESL Fuels biofuels market up date is produced in association with Portland Analytics

Image credit: Dreamstime, ESL Fuels