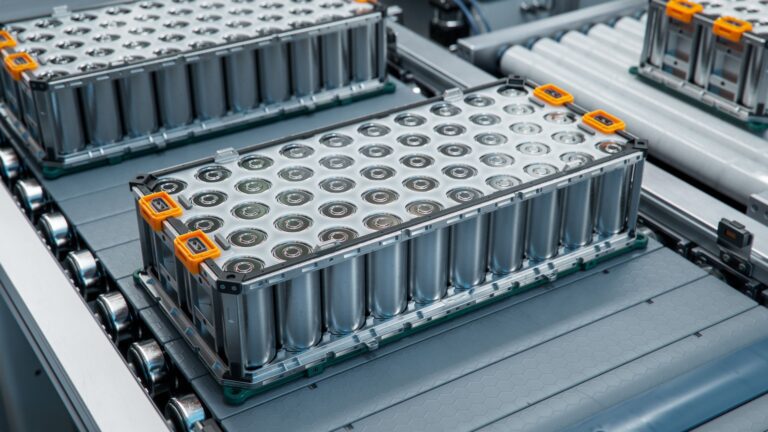

Our focus was largely on the technology, cost and operational practicality of running battery powered Heavy Goods Vehicles (HGVs), but as some observers have pointed out, the thorny issue of precious metal availability was never considered.

With the International Energy Agency (IEA) predicting that overall mineral demand for use in EVs will grow by 30 times to 2040, this does seem a valid question. So, this month, we will look at the challenges associated with sourcing the key raw materials for automotive batteries.

Lithium

Lithium-ion batteries make up over 90% of the world’s EV batteries, which obviously means that the first precious metal required is lithium itself. A supporting double-act of cobalt (to improve stability – i.e. the safety – of the battery) and nickel (to enhance energy density) make up the other 2 core raw materials. A typical electric car battery contains around 10kg of lithium, 15kg of cobalt and 40kg of nickel and although there is an array of other precious and non-precious metals required (palladium, silver, copper, aluminium), this report will only focus on the 3 “main” EV metals.

Lithium can receive and store electric charge quickly, plus it is the lightest metallic element in the periodic table, which explains why it is important to weight-sensitive industries such as the automotive sector. 75% of global resources are located in the “Lithium Triangle” that straddles Chile, Argentina and Bolivia.

Extraction is a (relatively) straight-forward affair, although enormous amounts of water are required (circa 1.9m litres of water for one tonne of lithium) and this is highly problematic for the very arid areas (e.g. Atacama desert in Chile), where lithium is normally found. In terms of the market, prices are typically stable, with supply currently surpassing demand.

This position is expected to continue until at least 2030, and as a result, lithium prices currently trade at lower levels than either cobalt or nickel; around $9,000 / tonne, which as a comparator, makes it cheaper than copper ($10,000 / t). The Energy Transitions Commission (ETC) predicts that whilst total demand for lithium for the next 25 years will exceed 20m tonnes, current production technology and known global lithium reserves will generate in excess of 25m tonnes in the same period.

Cobalt

Cobalt on the other hand, is a more problematic metal. The Democratic Republic of Congo (DRC) is the world’s leading producer of cobalt, accounting for about 70% of global extraction and 50% of global reserves. Up to a fifth of known cobalt mines in the DRC are non-regulated, “rogue” mines, often worked by children in extreme hazardous conditions and where the average daily wage is less than $10.

This concentration of production in such a politically unstable location makes for an extremely precarious supply-chain, and prices of cobalt reflect this. It currently trades around $31,000 / t but this is cheap compared to previous years, when the price hit a staggering $82,000 / t in April 2022 (once again as a comparator, Copper at this point was still around the $10,000 / t mark).

Global annual demand for cobalt is currently circa 200,000 tonnes, but this is expected to double by 2035, whilst supply is actually expected to decline post 2030. Forecasts for 2040 (based on current rates of extraction and known cobalt reserves) show that there will be a shortfall in cobalt of 300,000 tonnes per annum, which might make those Apr 22 prices seem remarkably good value…

Nickel

Finally, we have nickel, which is less dependent on the EV market, because it has uses elsewhere, for example in the nuclear industry, stainless steel and power transmission. It is also an abundant material, with ores containing nickel located in 25 countries around the world (the major deposits being Australia, Indonesia, South Africa, Russia and Canada).

2m tonnes of refined nickel is produced and consumed annually and only about 15% of that volume is used in EV batteries. The extraction and production of nickel is a well-established process, but energy intensive smelting (temperatures in excess of 1,350 deg C) and industrial levels of toxic waste make for another environmental horror show.

Because of the mineral’s plentiful reserves and the fact that supply continually outstrips demand, nickel prices rarely hit stratospheric levels. It currently has a traded price of $15,000 / t (largely reflecting the high costs of production) and even at “peak precious metal” (Spring 2022), the price did not surpass $50,000.

Battery recycling

It would seem then, that when it comes to lithium and nickel, there are few reasons on the supply side, why current and future demand from EV batteries cannot be met. Cobalt presents a greater problem because of geological scarcity, political instability and plain risk, all of which contribute to a deeply fragile supply chain.

Such red flags would typically point to huge price hurdles in the manufacture of EV batteries in the future, but two factors may come to the rescue. Firstly, there is much scientific development now going into the development of cobalt-free or cobalt-light batteries (alternatives such as iron-phosphate or manganese are feasible) and secondly, there is a rapidly growing market around the recycling of used batteries.

The World Economic Forum estimates that over 50% of end-of-life batteries will be recycled by 2030, with their original mineral content being re-smelted back into precious metals. This is forecast to reduce total demand for raw materials by 7%, whilst the IEA predicts that increased recycling of precious metals could reduce the need for new mining by as much as 40% by 2050.

Image credit: IStock/Sweet Bun Factory