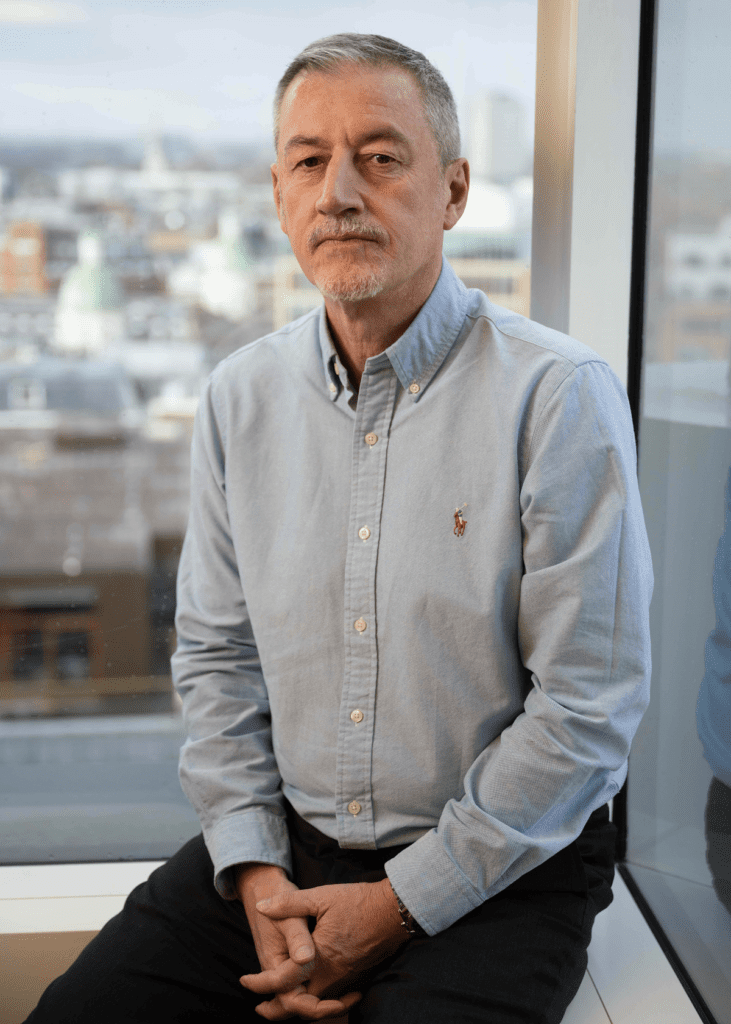

With Phillips 66 since 1989, the UK marketing role is one Rupert held previously between 2002 and 2009 and, in a recent interview with Rupert, Margaret Major, editor for Fuel Oil News, asked what had drawn him back to the UK role and how it has changed.

I always had a strong affiliation with the US, having spent time there earlier in my life and it was a job opportunity that took me back in 2014 for my second stint in Houston. I loved living in the states and could have easily stayed there, but this opportunity came up. It’s a role I had previously, based in Warwick from 2002 to 2009, and I really enjoyed it.

The emerging energy landscape presents a new challenge and I relish the opportunity to affect change, but, alongside that, the familiarity was appealing. From a job perspective I was excited to have the chance to come back and do this. From a personal perspective, the UK is still home to me.

There must have been substantial change in the UK role since 2009?

You’d be surprised – far less than you might expect. In a quirk of good timing, our customer conference took place a month after I returned, and it was great to see so many customers I hadn’t seen in 13 years. The industry doesn’t fundamentally change. Some of the players change and we’ve all moved on in age, but the basics of energy delivery remain the same.

Energy solutions may change over time but even some of the strategic objectives that we had when I was previously in this job remain because our customers’ needs don’t change.

They want reliability, competitive pricing, someone on the end of the phone if they have a problem.

So, in answer to your question, there’s a lot that hasn’t changed. What has changed is the fuels we supply but, even in a fully emerged energy world, what our customers want remains the same. As a result I see a lot of familiarity – of strategic objectives, customers and people in the organisation – and, as I said earlier, that was part of the appeal as it wasn’t about starting all over again.

Even in emerging energy, which is hugely exciting, the underpinning remains the same. Processes may evolve, but getting energy from A to B, at a price that gives the reseller a margin and that the end user can afford is fundamental.

The focus of our customer conference was fuelling the future and the customer perspective is that there can’t be one single solution to all of the issues that are out there, and I believe they are right. It’s going to be a combination – a multi-fuelled future.

Our message to our customers is that it is our role, as a company to de-risk their business and the future so that they don’t have to.

Are you rolling on with the emerging energy team and strategy?

Absolutely. And we’ve made good progress. Since your conversation with Renee, we’ve been installing EV chargers at a few of our company-owned retail sites. We have 11 company-owned locations which enables us to trial solutions. In the past we would say to our customers ‘we think this or we think that’ and now we’re able to say ‘we’ve learned this, we’ve learned that.’

We can ‘make the mistakes’ on a company owned business and, again, from a de-risking standpoint, use those learnings to help them.

We’ve also been working with other companies; an example would be a joint venture in Germany with a company called H2 Energy which has an innovative way of moving hydrogen around.

Renewable diesel for wholesale and retail is another area of strategic development.

We’re moving forward on a number of fronts and beginning the process of implementation, which allows us to test and learn.

We have two huge projects at Humber. One is Gigastack, using offshore wind power to produce hydrogen; the other is carbon capture, which is hugely important as we believe it is a key technology to support the industry to decarbonise.

In the Humber area there are depleted offshore gas fields where, years ago, gas was extracted and piped up to Humberside and elsewhere. Now pipeline companies plan to utilise the pipelines to transport carbon dioxide to be stored in the holes under the North Sea. New infrastructure will also be needed which will bring jobs to the area.

You can imagine the significant capital investment involved in doing that but we’re in a very unique position in the UK in having these places in which to capture carbon.

One advantage we have within Phillips 66 is our own research centre in Bartlesville in the US with over 100 scientists working on solutions to problems such as potential feedstocks for lower carbon liquid fuels. With increasing demand for used cooking oil (UCO) we are able to research other options such as tyre pyrolysis oil (TPO), where end-of-life tyres are broken down into a liquid that can feed the refinery. Because our research is ‘in house’ we are able to use them to help us define what our current refineries are capable of doing.

You talked about de-risking the future for your customers by backing the various potential solutions to see which gain traction and market acceptability or deliverability but that means a huge investment. Does the windfall tax affect that ability to invest in future solutions?

Currently the windfall tax is only applicable to companies extracting UK oil and gas, so at Phillips 66 Limited we are not directly impacted because we buy our oil and gas from the open market. As a country we are in tough place financially, but we also know how much the energy transition is going to cost and it’s an incredible amount of money, with investment crucial for continued growth

However big the challenge, to sit back and not do anything is not an option. We have to keep exploring pathways and try to make optimal decisions on the way. As a leader you must tread a really fine line between leading the way to the future you really want, but also being honest and open about the realities and the challenges along the way.

In terms of future energy solutions, you see a lot of terms raised on flagpoles but no one currently joining the dots. MPs, civil servants etc. migrate to different areas depending on their own opinions of what is best for their constituency. But we have to keep pushing ahead on all of these. We can’t be backing just one then finding out it’s the wrong horse. There are lots of well-intentioned groups, people and organisations. But where is the glue? Who’s driving the optimal solutions?

People talk about sitting down and understanding each other’s agendas. It’s early days, admittedly, but I’m not yet seeing that come to fruition.

For us it is a multi-solution approach. We believe that hydrocarbons will have a place for quite a few years from now but from there it’s ‘fill in the blanks’. We believe that there will be roles for hydrogen and electric and we’re seeing both of those already.

What’s the supply outlook for current fuels?

With regard to resilience, we continue to perform pretty well. There isn’t going to be a lot of spare product floating around in the current market. From my own trading days I recall the saying that ‘volatility is the friend of the trader’. Even traders are not enjoying the current market. They live for volatility but not this much volatility.

We rely on accurate customer demand forecasts and work closely with them to keep supply resilient. We’re in good shape, but always on the lookout for outliers.

At times when supply does become tight, and we have to prioritise contracted customers, we need to have very transparent conversations around spot sales. It’s a balance between risk and reward, and a choice that should be made with eyes wide open. If you’ve been a customer in that space, you’re probably trying to figure out what the risk is going forward, and will it be worse than where I’ve been before? Because, if it is, then maybe a change of approach is needed.

What about diesel this year?

We think diesel is going to be a struggle, to be honest, and it will be another difficult year. It’s a question of for how long? It really depends on how sanctions play out and what happens with the Ukraine war.

This is where we have been honest with our customers around product availability. We believe that there is likely to be little spare, and we don’t think that the market should be overly reliant on increased imports because we’re not convinced that extra barrels will be there, so we will manage supply accordingly. We are committed to being transparent with our customers and focused on operating excellence to meet demand.

Against these backdrops what are your hopes or milestones for your first year back in this role?

For me, this year is about a deep dive back into our strategy and key within that is emerging energy. Because, as we discussed, it both changes things, and it doesn’t change things.

We want to ensure that our strategy continues to be fit for the future and that we are able to measure against it on an ongoing basis using clear metrics, otherwise it’s very subjective as to whether you’ve made progress or not.

Maybe I’m overly simplistic, but, for me, fundamental to future success is to do the basics well, time and time again.

Our recent survey on the wholesale side gives us a list of things that are important to our customers. They’ll all stay on our list, but which do we need to be world class in and which do we just need to be good at? Ideally we’d love to be world class in all of it but that’s not feasible so we need to identify the top quartile and really focus on those and how we move forward on those whilst maintaining the level of the others.

We will be doing a lot more test and learn this year with both wholesale customers as well as retail, as we roll out more implementation of lower carbon fuels, hydrogen and EV charging.

What is your message to our community of wholesalers and distributors?

Don’t lose sight of the basics, even though the world is changing before our eyes. That’s certainly going to be our focus.

And we want to work even more closely with our customers to both share what we’re learning, but also to better understand what they are learning as well as what they are saying.

Our customers have a very different vantage point to us, and that relationship becomes even more important as we go through this transition. Open lines of communication and transparency – those things which were relevant when we weren’t in transition – just become even more critical now that we are.

We need to be holding hands and moving forwards together.