Primary energy sources:

The country relies almost equally on fossil fuels and non-fossil fuels for its sources of energy, as follows:

- Coal 3%

- Gas 17%

- Oil 32%

- Biofuels and waste 7%

- Electricity 41%

Last year’s demand, of 27.5 Mtoe, was about 17% below the recent peak, in 2013, of 33.0 Mtoe.

Almost all (99%) of the electricity is sourced from hydropower, produced at 31 generating plants. The country is entirely self-sufficient in oil and gas, out of the North Sea, and is a substantial exporter, in particular to the UK and the Netherlands who, respectively, source 42% and 17% of their requirements from Norway.

Crude oil production is currently running at around 85 mln Mt/year, down from the 2001 peak of 163 mln MT.

Turning attention to the refinery network and oil products demand.

Supply & Distribution:

There is now only one operating refinery in the country, the Equinor (formerly Statoil) facility at Mongstad, which is on the west coast, about 17 miles north of Bergen. This has a ‘nameplate’ capacity of 226,000 BD (just over 10 mln MT/ year) and was commissioned in 1975. Since start-up its distillation capacity has been doubled and substantial upgrading/ conversion capacity also installed. Crude oil for the refinery is sourced 100% from the company’s Troll field in the North Sea.

The country’s only other refinery, the Esso 110,000BD plant at Slagen (on the south coast) ceased crude oil / feedstock processing last year and is now an import terminal.

With two refineries, Norway had a significant surplus of the main refined product grades vs. indigenous market requirements. Even operating alone, the Mongstad plant will more than cover these requirements, leaving a modest surplus across all grades.

Stockholding obligations

Norway imposes emergency stockholding obligations on oil importers and oil producers who imported quantities of oil equal to, or more than, 10,000m3 during the preceding year (or who are expected to import/produce such quantities in the coming year). Emergency stocks may be comprised of gasoline, heavy fuels or auto diesel, diesel for construction purposes, light heating oil, kerosene, jet A1, or marine distillates. A maximum of 40% of emergency stocks may comprise crude oil, condensate, or semi-finished products.

Demand:

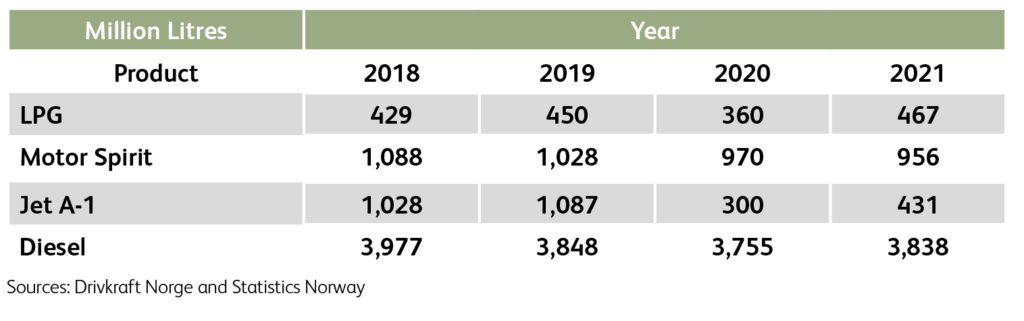

Consumption of refined products has remained relatively unchanged over the past four years, with only Jet A-1 showing a sharp fall-back, as it did everywhere, in 2020. The total for last year, at 8.2 bln litres, was just under 2% up on the previous year. Out-turns for the main grades are summarised in the table below.

Biofuels

Following public consultation, the Norwegian Environment Agency has proposed an increase in the amount of waste and advanced biofuels used in road and off-road transport from 1 July. However, the overall biofuels mandate for road fuels will fall as part of the proposals, from 24.5pc to 17pc by volume. The sub-mandate for waste and advanced biofuels for road use, comprising biofuels utilizing feedstocks from Annex IX part A and B of the EU’s Renewable Fuel Energy directive (RED II) and currently capped at 9pc, will increase to 12.5pc under the proposals.

Double counting for waste and advanced biofuels will no longer be accepted towards the overall target under the new proposals, except when the 12.5pc sub-mandate has been exceeded.

Since the beginning of 2020, 0.5% of aviation fuels must be advanced biofuels. Since these are counted as double, this is equal to 1%.

Changes in the competitive landscape

Three significant developments have featured over the past ten years in the competitive landscape involving acquisition of three existing major players by new entrants. These have been:

- In 2012 market leader, Statoil, divested of its marketing and distribution interests (across Europe) to Canadian convenience retailer, Alimentation Couche Tard, which has branded its site networks as Circle K

- In 2014 Shell divested of its Norwegian (and Swedish) downstream interests to Finnish company, ST1

- In 2017 Esso sold its forecourts’ business to DCC

Four companies dominate the market for the two ground transport fuels (2020 out-turns), with the following market shares: Circle K at 30%, Uno X at 20%, Esso (DCC) at 20% and ST 1 at 18%

Marketing:

Service station numbers declined from 2,158 to 1,750 over 2000-2010, since when they have stabilised at just over 1,800. During this time, within the total, company-owned outlets have increased by around 200, with a slightly lesser decline in independent dealers. Unmanned site numbers have risen by 60% and now comprise 40% of the total.

These four brands account for around 80% of the site network: Circle K, with 413 sites, Uno-X, with 475 sites, Esso (DCC owned), with 249 sites, and ST 1, with 274 sites.

Uno X is a fully unmanned network of independently owned sites, supplied by YX Energi, which is owned by Norwegian ‘conglomerate’ Reitangruppen.

The drive to decarbonise

In 2017, Norway introduced a measure to prohibit the use of heating oil from 1st January 2020 in new and old buildings, which applies equally to private homes and businesses as well as publicly-owned facilities.

The number of EV charging stations has expanded significantly over the past 5 years, from 7,700 to almost 17,000, including 3,300 fast chargers. This is, by some margin, the world’s most extensive charging network relative to the population served – in Norway’s case, 5.4 million. In comparison, neighbouring Sweden has a network of 11,500 serving a population of 10.3 million.

Norway’s incentive scheme, of tax breaks rather than subsidies, is one of the most generous in the world and has been highly effective in promoting EV sales. Last year these accounted for 64.5% of new car sales, rising to just over 80% by the start of this year, taking the total fleet to just under 500,000. The country is in the vanguard, globally, with regard to the extent of EV adoption, having been an early starter in the 1990s. In another ‘first’ Norway has announced a ban on new ICE vehicles by 2025 (cf 2030 in the UK).

Norway is in an enviable position as Europe’s largest oil/gas producer. Starting in the late 1960s, tax proceeds from this production have enabled it to build up the world’s largest sovereign wealth fund. This is currently valued at circa $1.35 trillion and will provide a financial underpinning to keep the country at the front end of global decarbonisation efforts and initiatives.

ROD PROWSE, worked for 30 years across the full spectrum of the downstream oil sector, in both the UK and USA, which has included leadership positions in both retail and wholesale fuels businesses. Rod draws on his extensive knowledge of this global industry to bring us ‘Industry Insights’.

Image credit: ID 120825744 @ Eugenesergeev | Dreamstime.com