News

Thin cover for winter?

European diesel and heating oil prices will be supported by a heavy autumn refinery maintenance schedule that is already prompting some interest to store product. But storage economics are looking uneconomic going forward, threatening thin cover for the winter, writes Chris Judge, senior products editor at Argus Media.

Whilst faltering economic growth in Europe in general, and in the UK in particular may improve diesel demand, the picture across Europe is still not encouraging for sellers.

The first half of 2013

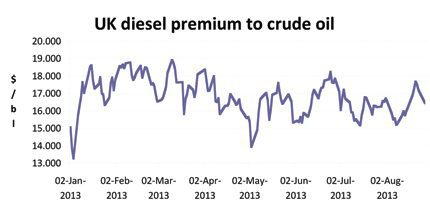

Over the first half of the year diesel demand limped along, rarely achieving the margins sellers had hoped for at the start of the year, despite short episodes of market tightness. The weak demand in Europe is underlined by car sales that have been falling almost continuously for nearly two years, with supply boosted by refinery upgrades. More spot diesel volumes were expected from Spain and Greece, while Israel’s ORL started up a new 25,000 b/d hydrocracker at its Haifa refinery, Portugal’s Galp launched its own 43,000 b/d hydrocracker, and a slew of Russian refineries worked on expanded diesel production.

Nagging concerns over margins meant that European refineries – particularly those in the Mediterranean – continually trimmed output, keeping buyers on their toes, especially through the summer months.

Heavily reliant on imports

Refinery maintenance dominates on the supply side with weak motor fuel demand dominating on the demand side. A key source of winter diesel, Swedish refiner Preem’s 220,000 b/d refinery in Lysekil, Sweden, closed last month for six weeks of scheduled maintenance. Also on the docket for autumn works are Exxon’s 246,000 b/d refinery in Antwerp and unspecified units at BP’s 400,000 b/d Rotterdam refinery, and a variety of key Russian plants.

The UK is heavily reliant on imports from Europe following the closure of Russian product exports are expected to fall sharply from September to November as a result. The total capacity loss is forecast at 5.4mn t, with most of the cut coming in September-October, compared with 3.75mn t off line during the 2012 turnarounds.

Demand concerns persist. The seasonal downturn in driving and agricultural consumption is compounded by weak economic growth in Europe and forecasts that western Europe’s automotive market will not begin to grow again until at least 2019. That said, demand figures for the first half of 2013 were mixed. In much of northern Europe demand continues to grow, albeit at unspectacular rates – up 3% year on year in the first half in Germany and up by 2% in the first five months in Sweden. Troubled Mediterranean Europe saw drops of 6% in the first five months in Spain and 3.3% in Italy.

While traders and refiners expect the maintenance programme to provide support, it does not match the abrupt loss of 600,000 b/d of refining capacity with the insolvency of European refiner Petroplus early in 2012, when autumn premiums to the benchmark Ice gasoil surged to nearly $60/t and diesel’s crack spread against Brent surpassed $25/bl.

With the sale of all but one of the Petroplus refineries – the 146,000 b/d Petit Couronne in France seems doomed to permanent closure – most of the company’s former capacity is now back on stream. And, despite the general agreement that there is refining overcapacity in Europe, optimism over longer run prospects for diesel is driving plans for capacity additions; Italy’s ENI has already restarted its idled 105,000 b/d Gela refinery in Sicily. The company has also announced a €700mn investment plan, including diesel maximisation, in a bid to return the loss-making plant to profit.