News

UK refining – hunting for answers

“The reduction in the number of UK refineries is very much progress driven and, reaction to changing market demand,” said Chris. “Refinery capacity has increased due to technological advances. Yes, the UK has fewer plants but the ones remaining are more efficient.“Plus, an inevitable consequence of the UK and EU drive for energy efficiency is demand destruction. With more efficient engines, demand for refinery products such as petrol continues to decrease but, until the recent recession this has been offset to a large degree by increased consumer mileage.“On the other hand, being more efficient in our oil consumption is a good way to achieve our carbon reduction without sacrificing our mobility. It also helps conserve supplies of this finite resource.”

In with the new As most majors have retreated from downstream, new players have entered the refining arena. “We welcome these newcomers, they’ve brought a fresh dynamic to UKPIA,” said Chris. “Whilst they don’t have the deep pockets of the integrated oil majors, their flat command and control structure offers a different business model.Q: So what do investors like Petrochina, Essar and Valero have to gain in our mature industry?

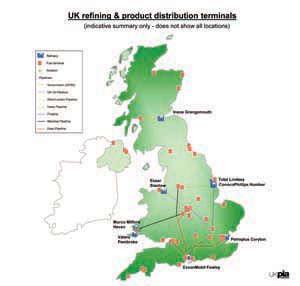

“A very handy toehold in Europe,” says Chris. “In Stanlow and Pembroke, Essar and Valero respectively, have acquired good assets relative to European standards. At Grangemouth, Petrochina and INEOS are using the site to develop an impressive chemicals portfolio.”

A large refinery reputedly contributes £60 million to the local economy. “Closed in 2009, Petroplus’ Teesside refinery was an ex-ICI plant, very simple in refinery complexity terms but closely integrated with petrochemical activities. The loss of that critical mass, and the associated high value jobs at these plants, has had a big impact on an area of the UK which can ill afford such a hit.”

Q: So will the UK ever see a new refinery?

“It would be difficult to see a case for building a new refinery – capacity wise we just don’t need it. But, under the right conditions and, with the right incentives, investment could be made at the remaining facilities.”

Q: What are the right conditions?

“They will be when the vital contribution of the UK’s oil industry to our energy security is fully recognised. It also requires a level playing field where UK refineries are not disadvantaged against European or global competitors.

Q: Will there ever be a level playing field?

“There could be,” said Chris. “It could be achieved if the UK and EU recognise that we can’t go it alone on some aspects of environmental policy. We may be world leaders in climate change policy but we must also consider the cost to our manufacturers.”

Coming soon – a refining strategy for the UK and a stock holding agency

In his introduction to UKPIA’s report on Fuelling the UK’s future: the role of our refining and downstream oil industry published in November 2011, Brian Worrall, then UKPIA president, said: “Given the right policy environment, the UK refining and downstream oil sector can continue to play a pivotal role.

KPIA and its members look forward to continuing to work with government and policy makers to achieve this goal.

Q: So, how receptive is the UK government to the oil refining industry?

“Very receptive,” reports Chris. “We’re finally moving forward on a proper refinery strategy for the UK which will be published in the third quarter of this year. We started lobbying in spring 2011 so this is quite a step forward.

“We also have a green light to progress an independent industry-funded agency to manage the UK’s compulsory oil stock holding. Administered by a board via obligated companies, the agency is expected to be functioning by 2014.”

Q: Does UKPIA now believe the government will apply policies that do not place the UK at a commercial disadvantage?

“We certainly hope so,” said Chris. “We expect that the refinery strategy exercise will lead the government to this conclusion. The problems at Coryton really galvanised the government into action – it provided clear evidence that refineries can and do shut; although in the case of Coryton, we very much hope a buyer will be found.

“For years, UKPIA has been saying that refineries could shut but, it took the demise of Petroplus to move refining up the political agenda. It reminds me of Spike Milligan’s epitaph – I told you I was ill.”

More challenges in the pipeline

Marine fuel – “Imminent changes in the specification of marine fuels will have a big impact. Under MARPOL proposals, the 2020 specification will see sulphur levels move closer to that of diesel. The effect on both the refining process and bunkering will be colossal. A substantial price increase may see ship owners chose the cheaper option of onboard scrubbing of exhaust gases to remove sulphur.

“Even by 2035, the International Energy Agency expects 80% of EU transport fuel demand to still be met from oil derivatives with most demand met by ordinary fuels particularly for the aviation and marine sectors,” added Chris.

Biofuels – UKPIA’s communications director, Nick Vandervell, who was also present at the interview, told FON: “Most biofuels currently used are first generation with complex sustainability issues in some cases. Second generation biofuels from biomass or advanced biofuels from algae for example, may have potential in the future.

“We see a more diverse fuel mix for transport including electric vehicles,” added Nick. “Technology favours hybrids unless there’s a breakthrough in battery technology in the short term.”

Q: Will we achieve 10% biofuels by 2020?

“Biofuels bring many issues, such as approval by vehicle manufacturers, storage and use and sustainability” replied Chris. “It’s likely that only by incentive – make the price the same or even cheaper – that people will switch to higher blend biodiesel.“

Kerosene – “Relative to the grand scheme of things, heating kerosene is a tiny market,” says Chris. “It’s very much a commercial issue. Distributors are not willing to invest in storage – an expensive asset for such a seasonal product. Demand patterns are difficult to predict, supplies can be problematic particularly in times of severe weather when supplies can be drawn down rapidly. Co-operative buying could be a way forward or maybe we need to switch to gas oil….?

The future

Q: Does UKPIA expect further UK refinery closures?

“No, we don’t expect more closures. As the reality of future supply problems has started to bite, UKPIA doesn’t believe that Europe will give up on refining.

“Total retaining the Lindsey refinery for the foreseeable future was welcome news as this plant has had the most recent major investment to increase diesel output.”

Q: Will the UK become just a storage facility?

“I can only contemplate the UK relying on more imported product if we lose the existing refinery structure. And, I cannot conceive that a government of any colour would allow this to happen.

“Some say that the UK could be supplied by imports, but that wouldn’t last forever. Being reliant on supply at the end of a long chain is problematic. Plus, bringing in finished product comes with shipping, jetty and pilot issues.

“The government, the industry and the country needs to ask the question – would we be happy being at the end of a supply chain from challenged areas of the world?

Q: What is the prospect for a ‘healthy, robust oil refining industry’ in the UK?

“We’ve got to be optimistic; we absolutely believe that a healthy, robust oil refining industry is achievable.”